Certificates of Deposit Interest Rates

Select from a wide range of CDs for savings and retirement goals at a fixed rate of returnCertificates of Deposit, also known as CDs, are a smart, safe choice for saving money for the future. By putting aside money for a set period of time, you can earn higher interest rates and reach your savings goals more quickly. And with CD terms ranging from just a few months to multiple years, there are options to fit both your short- and long-term needs.

Many of our CDs are IRA-eligible and offer potential tax benefits. If you have an IRA and are seeking secure, interest-earning options, we can help.

Explore our CD interest rates today and see how easy it is to save for your future.

Promotional CD Rates1

| Type of Certificate | Minimum Account Balance | Interest Rate | APY | Interest Compounding |

|---|---|---|---|---|

| 7-month CD | $1,000 | 3.80% | 3.85% | Quarterly |

| 13-month CD | $1,000 | 3.46% | 3.50% | Quarterly |

| 25-month CD | $1,000 | 3.46% | 3.50% | Quarterly |

| 10-year CD | $1,000 | 3.95% | 4.00% | Quarterly |

Standard CD Rates

| Type of Certificate | Minimum Account Balance | Interest Rate | APY | Interest Compounding |

|---|---|---|---|---|

| 91-day CD* | $1,000 | 0.05% | 0.05% | Simple |

| 6-month CD* | $1,000 | 0.10% | 0.10% | Simple |

| 1-year CD | $1,000 | 0.15% | 0.15% | Quarterly |

| 1-year IRA CD† | $1,000 | 0.15% | 0.15% | Quarterly |

| 1 ½-year CD | $1,000 | 0.15% | 0.15% | Quarterly |

| 2-year CD | $1,000 | 0.20% | 0.20% | Quarterly |

| 2 ½-year Homeowner CD* | $50, additions (any amount at any time) | 0.35% | 0.35% | Quarterly |

| 3-year CD | $1,000 | 0.20% | 0.20% | Quarterly |

| 4-year CD | $1,000 | 0.25% | 0.25% | Quarterly |

| 5-year CD | $1,000 | 0.35% | 0.35% | Quarterly |

Getting Started is Easy

1 All promotional CDs are IRA-eligible.

Rates are effective as of 3/5/2026. The Annual Percentage Yields (APYs) assume that the current interest rates will be in effect for one year and that the interest credited remains on deposit. Penalty for early withdrawal. A withdrawal will reduce earnings.

For blended rate CDs through the 457(b) Deferred Compensation program, please contact Retirement Services.

*CD is not IRA eligible.

† Minimum additional deposits of $25 are permitted during the term. For IRA customers only.

FAQs

Already enrolled in Online Bill Pay? Follow these steps to start using Zelle®:

- Log in to the Mobile AppFootnote 1 or Online Banking (web-based)

- Select "Send Money with Zelle®"

- Accept Terms and Conditions

- Select your U.S. mobile number or email address and deposit account

1 Mobile network carrier fees may apply.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

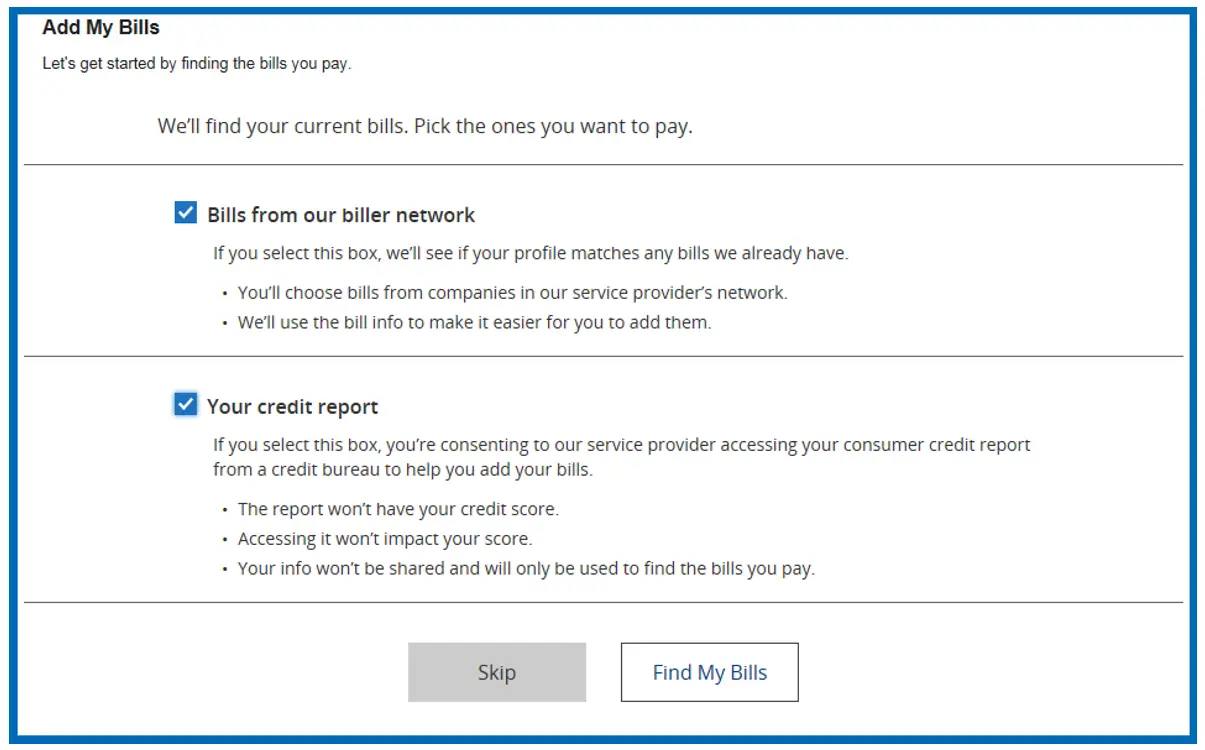

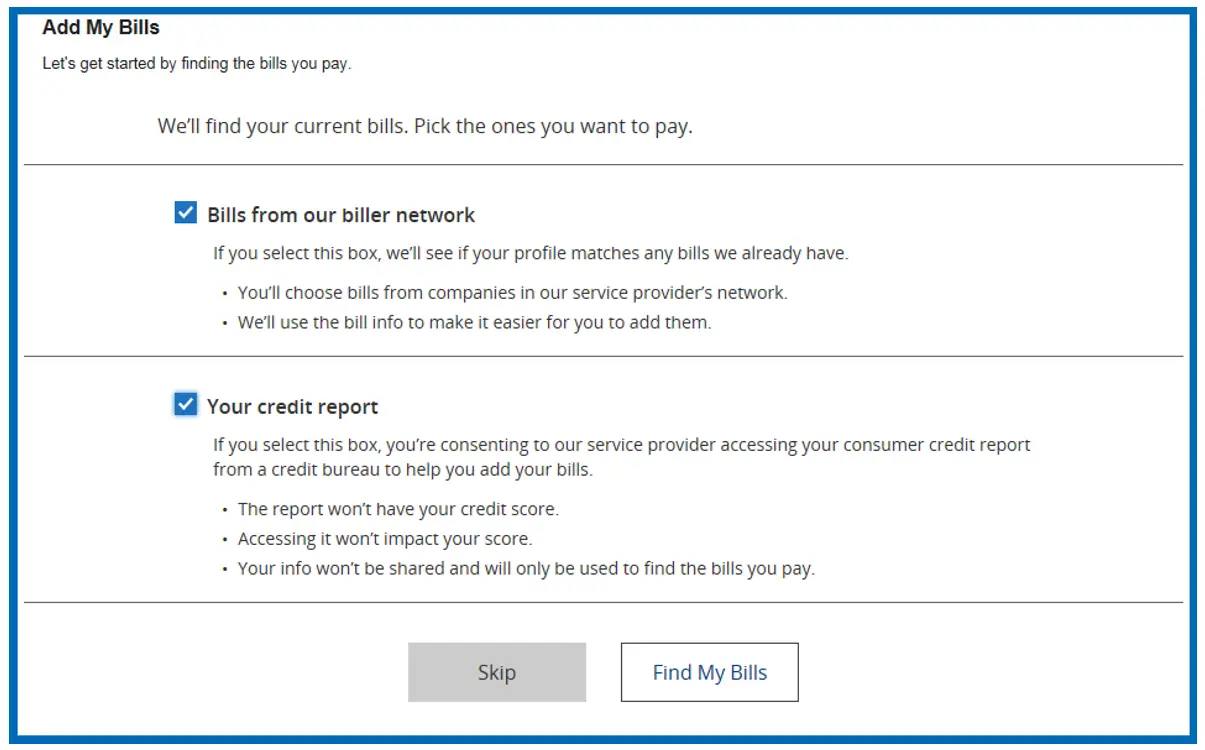

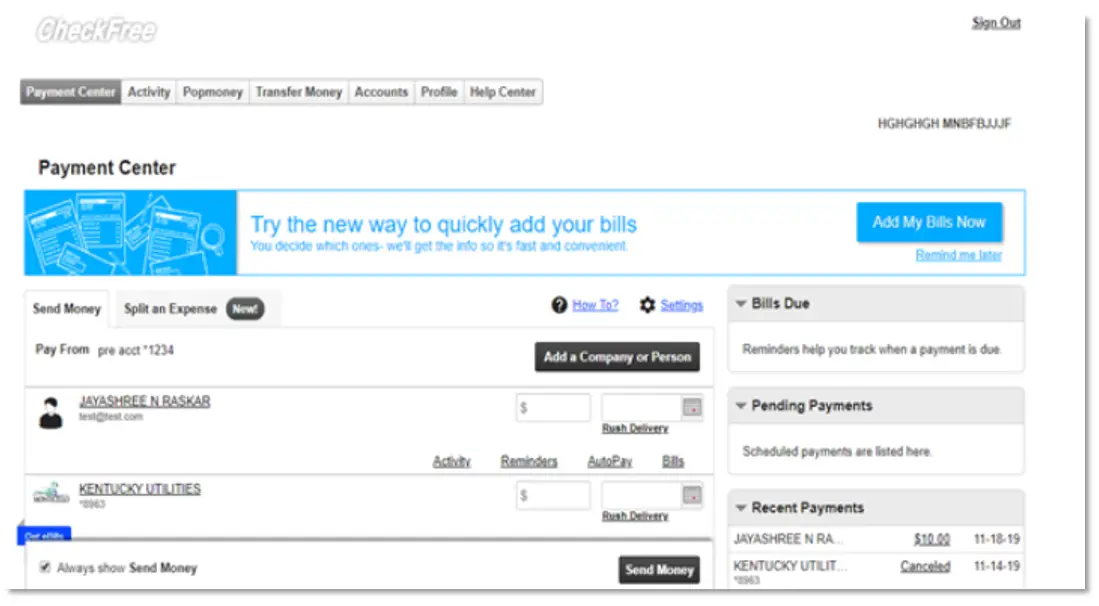

Bill Discovery will automatically connect you with your eligible bills by searching the biller database and if you consent, your credit bureau data. Once the bills are located, you can add them to your list of bills in one click. Bill Discovery greatly reduces the time it takes to set up Bill Pay and reduces the chance of manual input errors.

Bill Discovery will continually search for new bills and alert you if new bills have been found.

Bill Discovery is available in both Online Banking and the Mobile App.

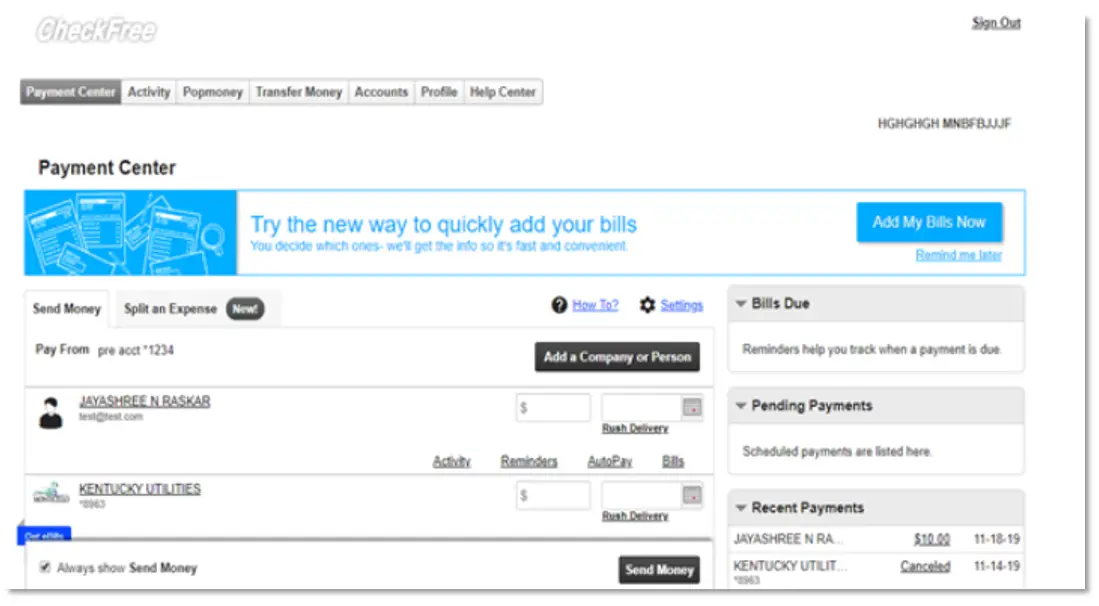

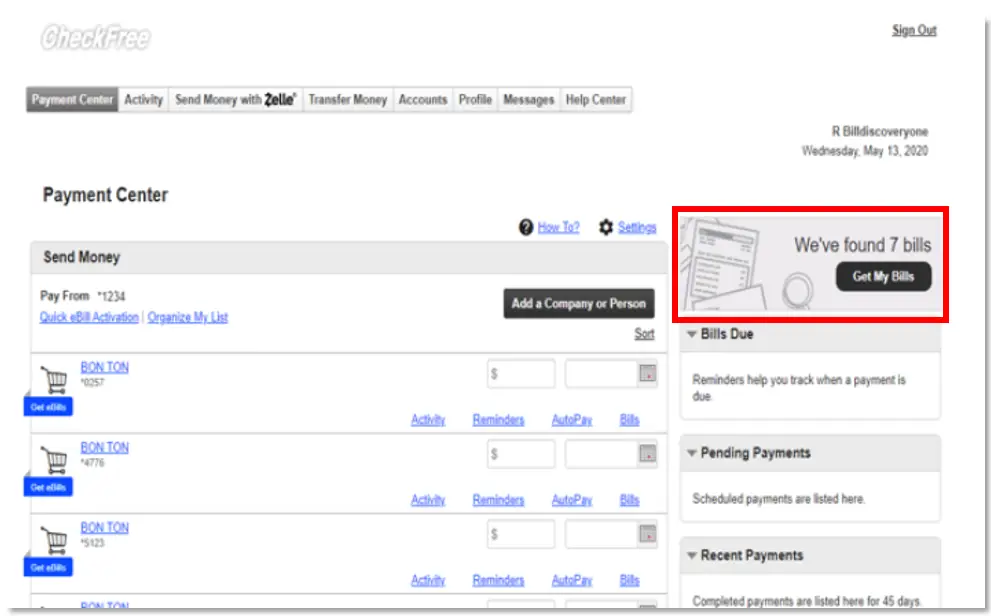

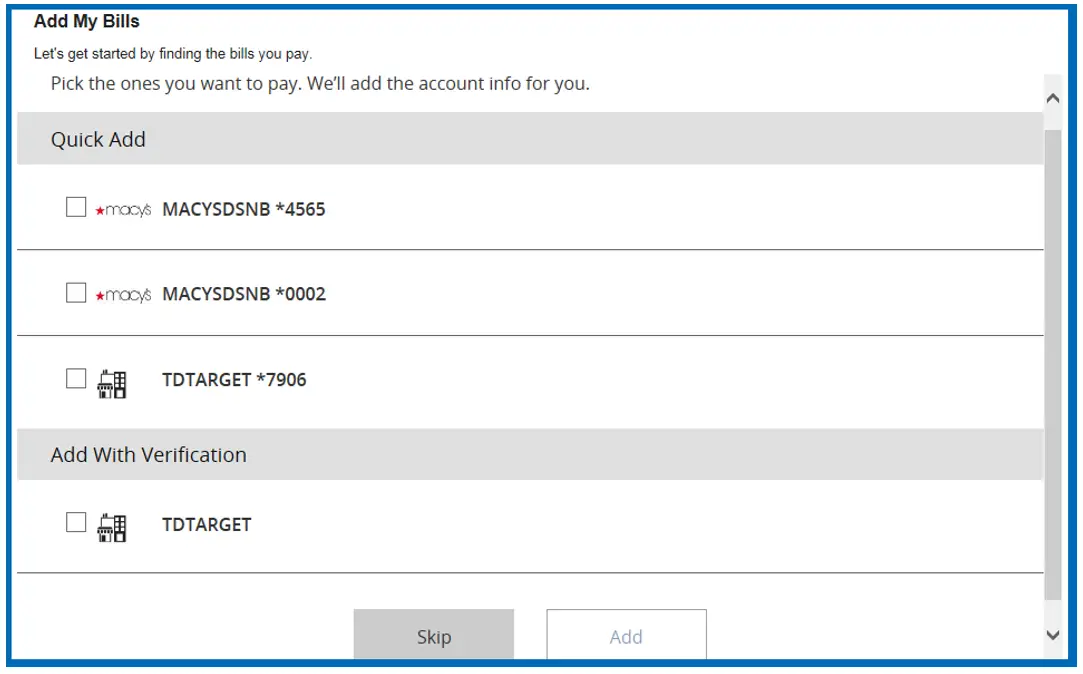

The following are screenshots of how you can set up and use this feature.

You first must consent to have your bills be found through the biller database and your credit bureau data. If you wish to have your credit data used, it is a soft inquiry and your credit score will not be impacted.

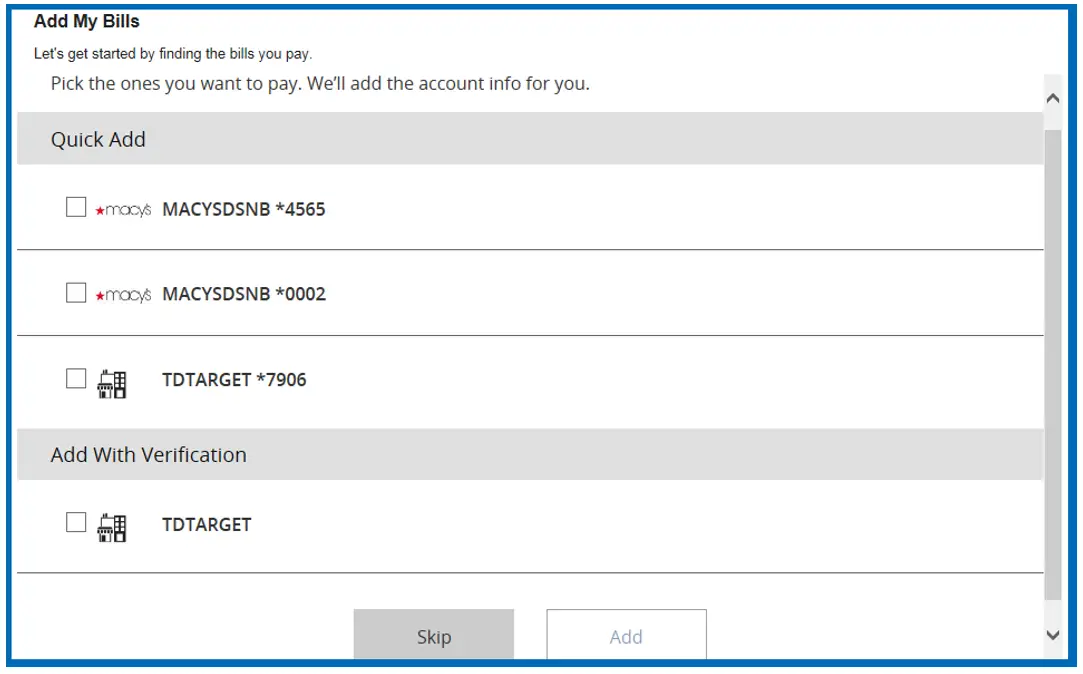

Once you provide consent and click Find My Bills, you will be presented with a page of potential payees.

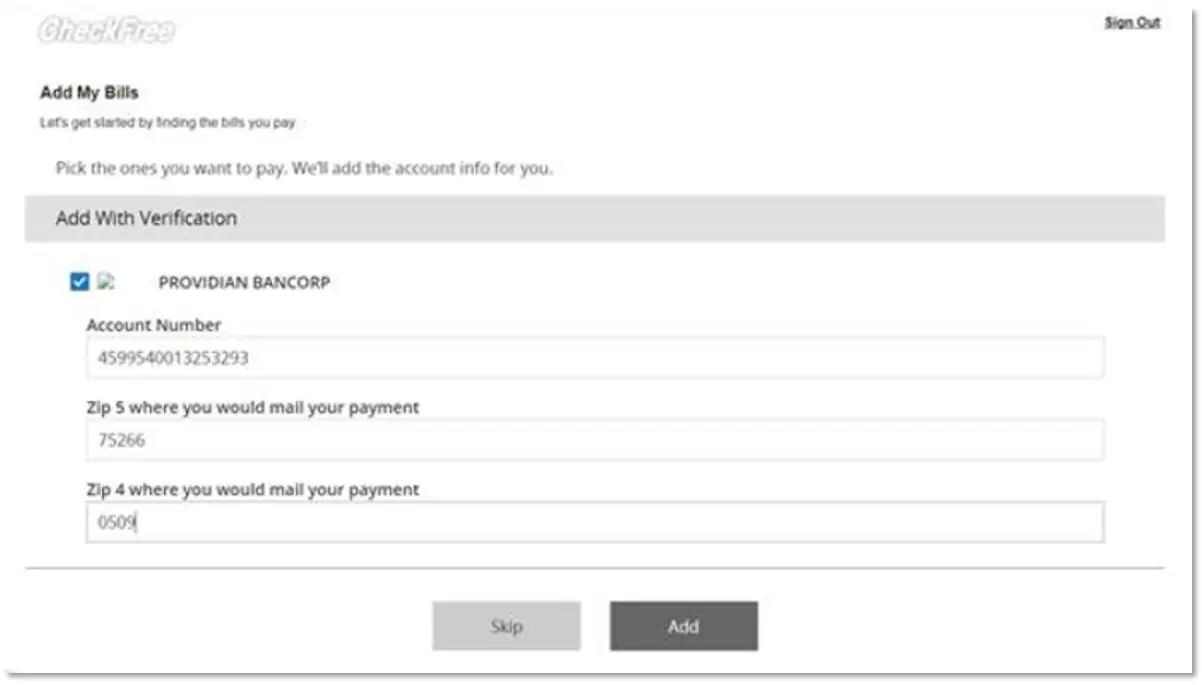

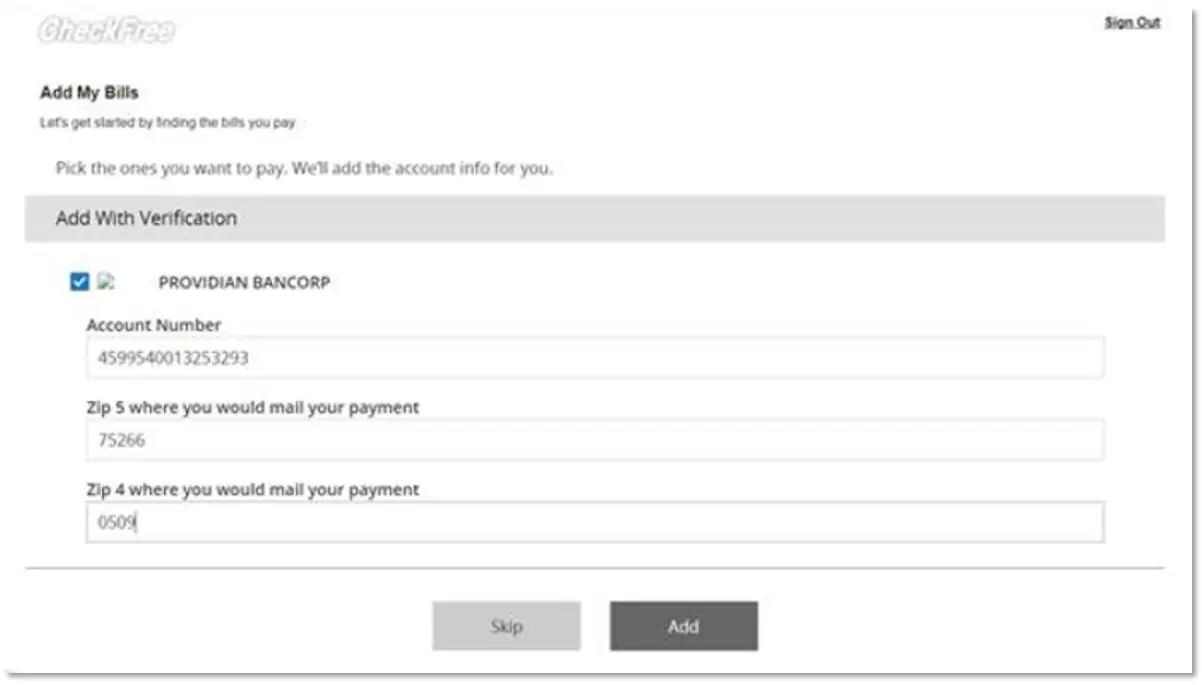

If biller(s) require additional verification upon selecting the biller, you will be provided with the additional verification fields. If the biller does not require any verification then you can add those directly by clicking the Add button.

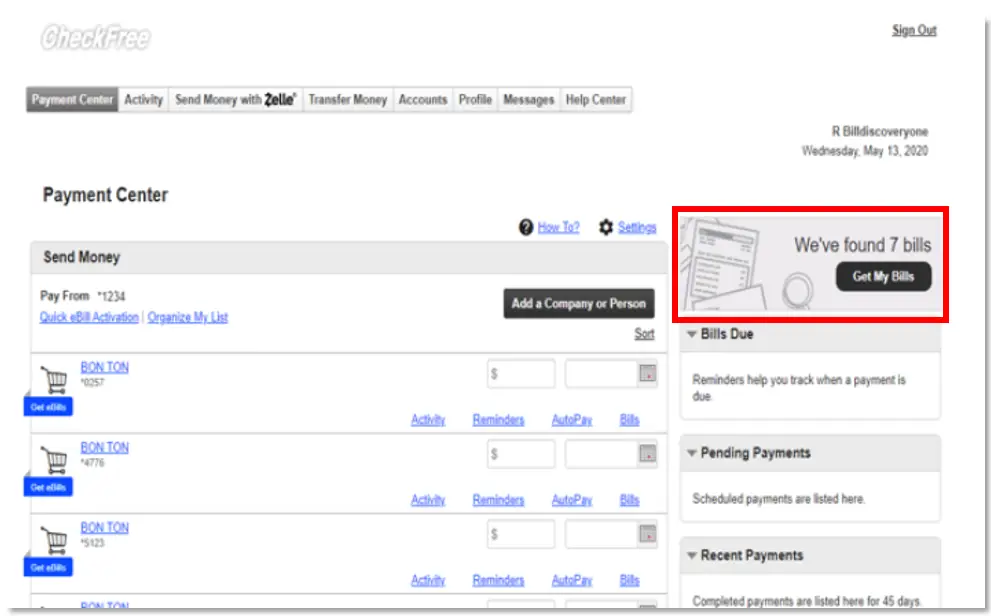

If you are not yet using Bill Discovery, you may see the following banner ad to begin using the feature.

After initial entry into Bill Discovery, new billers found among billers from the biller network or in your credit report will appear in the top, right area of your window. When clicking “Get My Bills”, you will be walked through the process of adding your bills in the same manner as the initial setup.

Yes, you can easily schedule an appointment at any of our offices or with one of our Mortgage Loan Officers through our online scheduling tool.

My Card Manager shows the most recent 50 debit card transactions posted within the last 30 days. Additional history can be viewed within the Accounts menu.

Refer to your account product guide or view our checking and savings account details to find personal account minimum requirements. For information on business account minimum requirements, please view the Business Accounts Fee Schedule.

Already enrolled in Online Bill Pay? Follow these steps to start using Zelle®:

- Log in to the Mobile AppFootnote 1 or Online Banking (web-based)

- Select "Send Money with Zelle®"

- Accept Terms and Conditions

- Select your U.S. mobile number or email address and deposit account

1 Mobile network carrier fees may apply.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Depending on how the processing of your application proceeds you will receive additional emails:

- More Information Needed For Your Application (Pending) - this email instructs you to contact us to gather additional information.

- Welcome to North Shore Bank! - Confirms that your new account is open. NOTE: This email contains your new account number. Your account number is the Application ID number.

- Please Validate Your Account - Communicates the steps to take to make your initial deposit to your new account.

Yes, you can send alerts to multiple email addresses and mobile phones when you log in on the Mobile App or in Online Banking. Under Manage Delivery, select to either add a new email address or add a new phone number.

If your email address or phone number changes, you can also delete any email addresses or phone numbers you would no longer like to receive alerts.

North Shore Bank credit cards are not supported through North Shore Bank’s Mobile App or Online Banking.

External account transfers are only available for personal deposit accounts in the Mobile App and Online Banking.

Yes, there are two fees you may see on your checking account statement.

- Currency Conversion Assessment Fee which is 0.2% of your transaction amount and may be charged for performing the currency conversion.

- ICBA or Issuer Cross-Border Assessment Fee which is 0.9% of your transaction amount.

You can set up your debit card for travel outside your normal footprint, including anywhere in the U.S. or internationally using any one of these methods:

- Using the Mobile App, select Cards, then Manage Travel Plans.

- In Online Banking, select Manage Cards, then Manage Travel Plans.

- Or within Online Banking (web-based) and select Settings, then Security Center, then Travel Notice. Simply provide the requested information.

Of course, you can also contact Customer Support at 877-672-2265 during business hours and provide us with your travel details. Outside of business hours, please call 888-437-0103, available 24/7.

Yes, we offer a variety of credit cards which provide you opportunities to earn rewards and other perks. Learn more about these different credit cards and enroll today!

Bill Discovery will automatically connect you with your eligible bills by searching the biller database and if you consent, your credit bureau data. Once the bills are located, you can add them to your list of bills in one click. Bill Discovery greatly reduces the time it takes to set up Bill Pay and reduces the chance of manual input errors.

Bill Discovery will continually search for new bills and alert you if new bills have been found.

Bill Discovery is available in both Online Banking and the Mobile App.

The following are screenshots of how you can set up and use this feature.

You first must consent to have your bills be found through the biller database and your credit bureau data. If you wish to have your credit data used, it is a soft inquiry and your credit score will not be impacted.

Once you provide consent and click Find My Bills, you will be presented with a page of potential payees.

If biller(s) require additional verification upon selecting the biller, you will be provided with the additional verification fields. If the biller does not require any verification then you can add those directly by clicking the Add button.

If you are not yet using Bill Discovery, you may see the following banner ad to begin using the feature.

After initial entry into Bill Discovery, new billers found among billers from the biller network or in your credit report will appear in the top, right area of your window. When clicking “Get My Bills”, you will be walked through the process of adding your bills in the same manner as the initial setup.

Yes, you can easily schedule an appointment at any of our offices or with one of our Mortgage Loan Officers through our online scheduling tool.

For your account security, shared Usernames are not permitted. Please use the Online Banking Enrollment Process to create a unique Username for each person. As a reminder, do not share the 4-digit secure code with anyone.

Yes. However before you cancel, please consider the importance of protecting you and your household from the financial hardship of lost wages caused by either a death or disability. By continuing with the coverage, you will continue to have the protection that you currently have today.

Effective January 1, 2018, pursuant to the Tax Cuts and Jobs Act (Pub. L. No. 115-97), a conversion from a Traditional IRA, SEP, or SIMPLE to a Roth IRA cannot be recharacterized. The law also prohibits recharacterizing amounts rolled over to a Roth IRA from other retirement plans, such as 401(k) or 403(b) plans.

A Roth IRA conversion made in 2017 may be recharacterized as a contribution to a traditional IRA if the recharacterization was made by October 15, 2018. A Roth IRA conversion made on or after January 1, 2018, cannot be recharacterized. For details, see “Recharacterizations” in IRS Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs).

If the repairs have been completed, North Shore Bank may need to make an inspection to confirm the repairs have been completed before releasing the check. In addition, we will need to be supplied with the insurance company's proof of loss, if not previously sent, and contractors' lien waivers, if applicable. If this happens to you, please contact Mortgage Services.

Yes. Be sure to include a deposit slip and write your account number on the check.

Find a North Shore Bank office, ATM or loan center near you.

You can also use Mobile Deposit within the Mobile App to deposit a check anytime from your mobile device.

Yes, all transactions made with your North Shore Bank debit card are covered by Mastercard’s Zero Liability Coverage, including those made through Digital Wallets.

Customers using a North Shore Bank debit card are not charged ATM fees for withdrawals at any North Shore Bank ATM or any one of 33,000 MoneyPass Network ATMs nationwide.

Use our ATM & Branch Locator to locate an in-network ATM near you.

If you use your North Shore Bank Debit Card at an out-of-network ATM, North Shore Bank will charge a $3 fee, and you may also be charged a fee by the ATM owner.

Customers with a checking account that comes with a Platinum Debit Card receive two free out-of-network ATM withdrawals per account per statement cycle. You may still be charged a fee by the ATM owner.

When you are directed off of our website you will see at “3rd Party” icon next to the linked copy. This is meant to let you know that you are leaving our site. When you are on our site we can assure that you are safe, however, we cannot guarantee the safety of other sites.

To remove a card from Apple Pay, simply select the card in the Wallet app and click on the ⓘ icon in the bottom corner to view the back of the card. Scroll to the bottom to find the ‘remove card’ option. After deleting, you can re-add this card to Apple Pay at any time.

Apple, the Apple logo, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Pay and Touch ID are trademarks of Apple Inc.

Distributions are not required at the time of retirement, but are required beginning in the year you attain the age of 72 years. However, you may elect to take your distribution at termination of employment as a lump sum, monthly, quarterly or annual payment. You may also choose to roll over your funds as permitted in your plan document. North Shore Bank will assist you in structuring your repayments to meet your individual needs and goals.

- Prepare the Check: Flatten the check and place it on a dark, non-reflective surface.

- Ensure Good Lighting: Make sure there is enough light to distinguish the check from the background.

- Align the Check: Use the horizontal and vertical guides on your screen to properly frame the check.

- Automatic Capture: The camera will automatically take the picture once aligned.

- Review the Image: if the check is readable, click Use Photo to proceed. If not, select Retake to try again.

- Alternative Deposit: If the system can’t interpret the check, you can deposit it at any branch or North Shore Bank ATM.

Important: Endorse the back of the check with your signature and include the statement “For North Shore Bank Mobile Deposit Only.”

Message and data rates may apply when using the Mobile App.

No, you may select any dealer. All car dealers can work directly with North Shore Bank.

Yes, you can add your contactless debit card to your digital wallet.

Watch a video tutorial or view a click-through demo.

Internal transfers are moved immediately if the transfer is made during normal processing hours. Otherwise the funds should appear in your account in 1 business day.

Message and data rates may apply when using the Mobile App.

When you register for the online loan payment service, you are able to establish login credentials that will grant you additional functionality, such as setting up recurring payments. If you choose not to register, you can still submit a payment after validating select information. Examples of this information include your account number, last name, address, zip code, last four digits of your Social Security Number (SSN).

Yes, our Balance Checking account is certified by Bank On as a low-cost and high-functioning account that can help customers build money management skills. Learn more about Balance Checking.

As long as you have a North Shore Bank login, your child’s checking or savings account will automatically appear in your account view when you log in to either Online Banking or the Mobile App.

You may want to give your child’s account a “Nickname” to easily identify it:

- To customize the account name, log in to Online Banking, select the account, then select Account Info. Or, if you’re in the Mobile App, from the home page, select Edit, then select the account you want to nickname.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

No; only posted or cleared debit card transactions can be disputed because pending charges are temporary and may change.

Consider calling the merchant first, as they may resolve your claim faster. We may also require information from the merchant to process a claim, so contacting them directly may save you time.

The merchant's contact information is typically found on your receipt, email confirmation, or billing statement.

Yes, we offer a unique account that helps you build your financial IQ without worrying about overdrafts. Learn more about Balance Checking.

To view the current contribution limits, visit the IRS website.

North Shore Bank is a great place to work! To see current career and job openings, please visit careers.northshorebank.com. Thank you for your interest!

To add the North Shore Bank Mobile App to your phone, install the North Shore Bank personal banking app by downloading directly from the Apple App Store or Google Play Store. Log in to the Mobile App using your username and password.

If this is the first time you are accessing your North Shore Bank accounts in Online Banking (web-based) or the Mobile App, you’ll need the following information to complete the enrollment process:

- Social Security Number

- Your 10-digit account number (checking or savings), including any leading zeros and excluding dashes

- Date of birth

- Zip code

Once you have submitted this information, you will be able to create your unique username and password and establish your security challenge questions.

When your enrollment is complete, you will be able to access your North Shore Bank accounts in Online Banking (web-based) or the Mobile App.

Message and data rates may apply when using the Mobile App.

No. At this time we are unable to accept electronic transfers for lease payments.

With the North Shore Bank Mobile App, you can conveniently deposit checks by capturing an electronic image and submitting it through the app. Your funds will be deposited into your checking or savings account, and we’ll securely store check images for accurate recordkeeping.

To use Mobile Deposit, simply take a photo of the front and back of your endorsed check, making sure to write “For North Shore Bank Mobile Deposit Only” with your signature.

You can submit mobile deposits anytime, with one check per transaction. There’s no limit on the number of personal or business deposits you can make each business day; however, a maximum deposit of $5,000 per day per user does apply.* If you need a higher limit, please contact Customer Support at 877-672-2265.

In some cases, your check may be processed within minutes, later the same day, or by the next business day. You will receive an email notification confirming whether your mobile deposit was accepted or rejected. View a quick demo.

All check deposits made through Mobile Deposit are subject to verification and final approval. Mobile deposits received and approved before 5:30 p.m. CST on a business day are generally available the next business day. New accounts have different availability schedules. For details on the Funds Availability Policy, please refer to the Deposit Account Agreement.

* Deposit limits may vary and are subject to change. For full details, please refer to our Terms and Conditions in the Mobile App.

Message and data rates may apply when using the Mobile App.

An appraisal fee may be necessary, depending on the value and equity of the home.

When making purchases at a retailer that accepts Apple Pay as payment, hold your device over the terminal and accept the charge with your fingerprint or passcode when prompted. A subtle vibration and beep lets you know the purchase was successful.

Your experience with Apple Pay may vary by merchant. If asked to verify the last 4 digits of a card number give the merchant the last four digits of the Device Account Number instead. The Device Account Number can be found by selecting the ⓘ icon while viewing your card in the Wallet app. You may also be asked to provide a signature or debit card PIN to complete your transaction.

You can also use Apple Pay on your iPhone or iPad to make purchases within participating mobile apps. Look for the Apple Pay logo while completing an in-app purchase to use this feature.

Apple, the Apple logo, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Pay and Touch ID are trademarks of Apple Inc.

You are not able to change your statement date.

We absolutely will accept coin deposits! In fact, we have coin counting machines at our offices to accommodate our customers.

Find a North Shore Bank office, Video Teller or ATM near you

North Shore Bank customers can make ATM deposits at most of our ATMs.

Yes, if you are enrolled in eStatements, you can download and print any statement found in your document list.

If you do not have estatements, enroll today using the Mobile App or Online Banking. You’ll get

- Convenient access up to 18 months of your checking or savings statements

- Email notifications that let you know when your statement is ready

- Downloadable copies of your statements to save on your computer or print

- Reduced risk of compromised account information due to mail theft

- No more shredding of paper statements

We offer business loans. Please call one of our Business Loan Officers at an office near you.

Find a North Shore Bank office, ATM or loan center near you.

Yes, North Shore Bank is a guarantor and a member of STAMP (Securities Transfer Agents Medallion Program). Please contact your local branch for more information.

Are you looking for a rewards card that earns automatic bonus points on every purchase, every month? Or maybe you prefer a card to pay down your balances on other credit cards faster or to save on interest. Whatever your needs, we have a credit card that’s right for you!

Learn more and apply online today:

No. A new, unique secure code will be sent to you via a verification alert each time it is required.

- Standard transfers arrive in the receiving account within three business days. Transfer must be initiated by 12:00 am Central Time. For Standard transfers, you will see the debit posted to the account the money is coming from before you see the transferred amount credited to your receiving account.

- Next-day transfers arrive in the receiving account on the next business day. Transfer must be initiated by 7:00 pm Central Time. You must satisfy certain criteria before having the ability to send inbound and outbound Next-Day transfers. Each account must qualify independently. Next-Day transfer qualifications include:

- Successful transfers of at least $500, either in one transfer or multiple via Standard delivery

- Seven days must have passed since the $500 in transfers were completed

- No negative or non-sufficient funds items in a 3-month period

- For Next-Day transfers only, 100% of the transaction amount must be available and the minimum available balance in the account must be at least $100

My Card Manager shows the most recent 50 debit card transactions posted within the last 30 days. Additional history can be viewed within the Accounts menu.

- Locate Alerts under Quick Links or on the More page.

- Turn on Push Notifications and then select Account Alerts.

- Next, choose an account and select Add new alert.

- Select the type of alert and set its criteria.

- Under Delivery Methods, activate push notification, email, and/or text message and select Save.

Set up email and/or text account alerts from Online Banking:

- Navigate to Settings > Security Center > Account and Security Alerts.

- Use the Manage Alerts tab to choose and customize the alerts you want. You will also choose the accounts you would like the alert placed on and what email address or phone number you want them sent to.

- Reapply for a HELOC. Reapply now and we’ll waive the annual fee for the first year.

- If you have a balance on your HELOC, you can convert your remaining HELOC balance to a fixed rate loan.

- If you have a balance, you can pay the balance of your HELOC in full. The line of credit will expire and no longer be available for use after the maturity date.

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card.

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card.

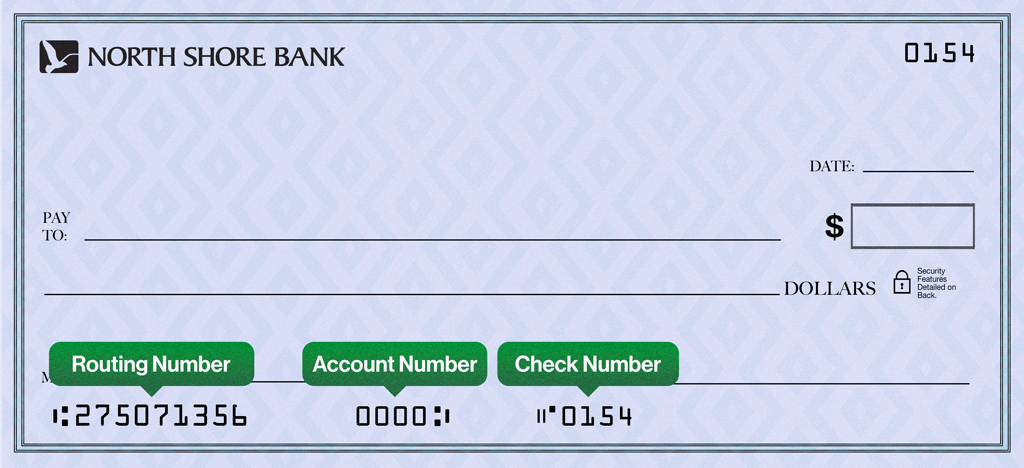

To set up a transfer from your checking account at another bank, you will need your current bank's routing number and account number. Typically, this information is found on a printed check, deposit ticket or account statement.

Using a prepaid card to fund a new account is highly discouraged. In most cases it does not contain the necessary information required to successfully fund an account. Please visit a North Shore Bank location to open the account.

To find out your HELOC balance, you can view your account information online, visit your nearby branch or call Customer Support at 877-672-2265.

To set up Quiet Times, click on the Manage Delivery tab in Alerts within Online Banking. In the Quiet Times section, you can edit the quiet time for email and text notifications.

"Quiet Time" controls are not supported in the Mobile App.

North Shore Bank’s ATMs will guide you through making a deposit or withdrawal. As ATM functionality varies, we recommend visiting our ATM & Branch Locator to learn about the capabilities of the ATMs near you.

Generally, here are the steps to take when making a deposit:

- Insert your debit card and enter your PIN.

- Select if you want a receipt with your transaction.

- Select Deposit.

- Select the account you want to receive your deposit.

- It will prompt you that you can deposit cash, checks, or both. Then, click Continue.

- Insert your cash and/or checks. No envelope or deposit slip is required.

- A summary of your cash and checks will show up on the screen and you will be asked to confirm the dollar amount of the total deposit.

- Take your debit card and receipt (if you chose to have one printed in step 2).

- Standard transfers to an external account are free

- Next-day transfers to an external account incur a $3 fee per transfer

- There is no fee for transferring money into your North Shore Bank accounts from an external financial institution

- There is also no fee for transferring money between North Shore Bank accounts

Credit card payments can be made online or by mail. Mailed payments can be sent to:

Cardmember Service

P.O. Box 790408

St. Louis, MO 63179-0408

Zelle® is a fast, safe, and easy way to send money to someone within minutes1. With just an email address or U.S. mobile phone number, you can send money to people you trust, even if they don’t bank with North Shore Bank2.

1 Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®.

2 To send or receive money with Zelle®, both parties must have an eligible checking or savings account.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

You will receive the verification alert that contains your secure code any time you need to be authenticated, such as when changing personal information.

The verification alert process is driven by both your IP address and the cookies on your browser. If you switch computers or browsers, or clear your cookies, you will receive the verification alert, and will be prompted to enter the 4-digit secure code.

Yes, you can connect both your Personal Online Banking and Business Online Banking accounts to QuickBooks Self-Employed.

You can learn more by viewing our Security Statement.

When opening a deposit account online, you can choose to upload a photo of your driver's license to assist with prefilling your personal information. In addition, to assist with verifying your identity, you can also upload a photo of yourself. You are not required to supply an image of yourself or your driver's license, however, for security reasons, it is recommended to ensure a more efficient application process. If you choose to supply these images, we retain them with your online application.

If you have trouble uploading the images, you can manually enter in your personal information. Please keep the following in mind when taking a picture of your photo ID:

• Ensure the ID fills the complete frame size on your screen

• Place your ID on a dark surface

• Ensure you have ample light

North Shore Bank does not list properties that we currently own.

To obtain a credit report please follow this link.

All North Shore Bank customers can also track their credit using My Credit Score, which is free through the Mobile App or within Online Banking. Your full credit report is available in My Credit Score.

For information on account minimum requirements, please view the current Personal Accounts Fee Schedule or Business Accounts Fee Schedule.

For a fast, secure way to pay in stores, in apps or online, use your North Shore Bank Debit Card with Apple Pay.

Adding your debit card to Google Pay with My Card Manager and the Mobile App:

- To quickly add your North Shore Bank debit card to Google Pay, log in to North Shore Bank's Mobile App and navigate to the "Cards" menu.

- From there, you can locate the card you wish to add and tap the "Add to Google Pay..." banner.

- Next, tap the "Add to Wallet" button to begin the process. All of your card information is pre-populated. Once complete, your North Shore Bank debit card will be visible in your Google Pay wallet.

How to add your North Shore Bank debit card to Google Pay:

- Open the Google Pay app on your mobile device

- Capture your debit card information using your device's camera or enter the information manually

- Use Google Pay during your next shopping trip, or online

Additional information:

You cannot close your bank accounts (checking/savings/loans) online. You can bring the account to a $0.01 balance, however penalties/fees may be issued. If you wish to close an account, please stop by your nearest North Shore Bank office or call Customer Support at 877-672-2265.

Yes, we will pull a credit report to calculate the best option. Though a credit report is helpful in the decision-making process, it’s not the only record we review that determines decision.

The minimum deferral is $10.00 per pay period. The maximum deferral may change annually. As of tax year 2026, the contribution limit is $24,500. Employees age 50 and older are eligible for catch-up contributions of an additional $8,000 for a total allowable of $32,500. There is a $11,250 catchup for participants age 60-62 for a total allowable of $35,750.

We suggest you shred the check once the deposited funds are available in your account.

Message and data rates may apply when using the Mobile App.

Yes, you can change a scheduled payment at any time before it is processed. The system displays an error message if you attempt to modify a payment after it has been processed.

*Other criteria may apply. Consult your Health Insurance Provider to be certain you are eligible for an HSA. The Bank does not determine your eligibility.

Stop payments cannot be placed on one-time, everyday point-of-sale (POS) debit card transactions.

Stop payments can be placed only if the transaction is a recurring payment. The bank must be notified three business days before the recurring payment posts to the account. A stop payment fee applies. For current fees, please refer to our Personal Accounts Fee Schedule.

Also, as an eligible individual, you may contribute an extra ‘‘catch-up’’ amount from age 55 until you’re enrolled in Medicare. However, eligible spouses may not contribute their ‘‘catch-up’’ amounts to the same HSA. Instead, each must have their own HSA. You may make contributions in the current year for the previous year if you’re eligible and if your contribution is made by the tax-filing deadline (excluding extensions).

To view the current contribution limits, visit the IRS website.

With home-based loans, you will not be able to use our online loan payment service to pay off your Home Equity Loan or Mortgage loan. Instead, you will need to contact Customer Support at 877-672-2265 to request the payoff amount.

When you apply for a mortgage at North Shore Bank, you can also take advantage of other products to save money and increase your financial flexibility.

For example, you’ll get a discount on closing costs for a new mortgage loan when you open a North Shore Bank checking account.

And every eligible mortgage applicant is also considered for a home equity line of credit at no obligation – offering an essential tool for financial flexibility and peace of mind in your new home.

- Instant buying power for major expenses, no questions asked

- Easy access with funds transferred directly to your North Shore Bank checking account

- Lower interest rates and easier payments than credit cards

- Less impact on your monthly cash flow

There’s more to your financial picture than a mortgage, so at North Shore Bank we offer more ways to benefit. Contact our loan professionals to learn more, or call us at 877-677-2265.

We offer safe deposit boxes at many of our locations. Please call your local office or view its location page to see if safe deposit boxes are offered.

Find an Office, Video Teller or ATM near you.

Safe Deposit Boxes are not FDIC insured.

Mobile Deposit is protected by several layers of security. We use 128-bit SSL encryption technology to protect your financial activities while using the Mobile App.

Message and data rates may apply when using the Mobile App.

Since the inception of the North Shore Bank Deferred compensation program, the bank has assessed no service charges or administrative fees for funds allocated to a North Shore Bank Certificate of Deposit. A small annual asset fee is incurred when funds are allocated to the mutual fund options.

Note:

- Our representatives may not give legal or tax advice. Please consult your attorney or tax advisor for answers to your specific tax questions.

- Your North Shore Bank 457(b) Plan can be funded by both FDIC insured North Shore Bank Certificates of Deposit (CDs) and/or non-Bank investments provided through TransAmerica Funds.

- Investments held in North Shore Bank CDs are FDIC insured.

- However, investments other than North Shore Bank CDs are NOT a deposit or other obligation of the Bank or its affiliates; NOT insured by the FDIC or any other agency of the United States; are subject to investment risk, including possible loss of value.

You can apply for a car loan online, even if you have not found your dream vehicle. We will just need an approximate loan amount for your application.

Learn more about our auto loans or apply for your loan online.

Enrolling in eStatements - Online Banking (web-based)

- After logging into Online Banking select your loan account.

- Locate and click on the Online Statements link (to the right of your green account balance tile). This will launch a new eStatements window, and your settings can be accessed there, from the Account Access link.

- You will be given the option to select which accounts you would like to receive eStatements.

- Next, you will be asked to read and agree to terms and conditions and be asked to view a PDF to check the capability of your computer.

- After reviewing the Term and Conditions and viewing the PDF you will be asked to enter a code that was viewed on the PDF and enter that into the space provided as well as check a box to accept the Term and Conditions.

Enrolling in eStatements – Mobile App

- After logging into the Mobile App, navigate to the More menu, then select Statements & documents

- You will be given the option to select which accounts you would like to receive eStatements.

- Next, you will be asked to read and agree to terms and conditions and be asked to view a PDF to check the capability of your device.

- After reviewing the Term and Conditions and viewing the PDF you will be asked to enter a code that was viewed on the PDF and enter that into the space provided as well as check a box to accept the Term and Conditions.

You are now enrolled in eStatements.

Images of canceled checks can be viewed, printed, or saved at no charge when you log in to the Mobile App or Online Banking. Customer Support can also provide copies by mail or you can visit your nearby branch to obtain a copy (fees may apply).

Message and data rates may apply when using the Mobile App.

ATM withdrawals have a daily limit of $1,000, which may vary depending on the ATM. This limit also includes an additional $15 to cover any ATM fees that may be assessed.

For a fast, secure way to pay in stores, in apps or online, use your North Shore Bank Debit Card with Apple Pay.

Adding your debit card to Apple Pay with My Card Manager and the Mobile App:

- To quickly add your North Shore Bank debit card to Apple Pay, log in to North Shore Bank's Mobile App and navigate to the "Cards" menu.

- From there, you can locate the card you wish to add and tap the "Add to Apple Pay..." banner.

- Next, tap the "Add to Apple Wallet" button to begin the process. All of your card information is pre-populated. Once complete, your North Shore Bank debit card will be visible in your Apple Pay wallet.

Manually add your North Shore Bank debit card to Apple Pay:

- Open the Wallet app on your Apple device

- Capture your debit card information using your device's camera or enter the information manually

- Use Apple Pay during your next shopping trip, or online

Additional information:

- Apple Pay FAQs

- Terms and Conditions for North Shore Bank's Digital Wallet services

- View compatible Apple Pay devices.

Apple, the Apple logo, and iPhone® are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Pay and Touch ID are trademarks of Apple Inc.

While paper statements are available for a fee, eStatements are free for all accounts.

If you do not have estatements, enroll today using the Mobile App or Online Banking. You’ll get

- Convenient access up to 18 months of your checking or savings statements

- Email notifications that let you know when your statement is ready

- Downloadable copies of your statements to save on your computer or print

- Reduced risk of compromised account information due to mail theft

- No more shredding of paper statements

Not to worry! You have up to ten days to complete your application after it’s been started. You can save your progress and resume later. Also, you can begin your application on your smartphone and resume it on your desktop or laptop, or vice versa.

To save your application progress, enter your email address to receive a link to resume your application at a later time.

To help you stay informed, view North Shore Bank’s resources about Identity Theft Prevention & Protection.

-

Launch QuickBooks and select the option to set up Online Banking Setup. This is found under the Banking menu, by selecting Online Banking Setup.

-

In the search field provided, type in “North Shore Bank”. You will see multiple results returned. Be sure to select “North Shore Bank – WI-QB DC” and select Next.

-

You will be prompted to log into your Business Online Banking account at North Shore bank to complete the process. Follow the on-screen instructions to finish setting up Business Online Banking access.

-

After the connection has been established and transactions have been downloaded, you may customize your QuickBooks settings for this account. When you’re satisfied, select Continue.

The next time you launch QuickBooks, your recent transactions will be automatically downloaded.

If you have five unsuccessful login attempts, you will be locked out. Please contact Customer Support for assistance. You will be required to provide additional verification by phone.

Visa Business Reporting makes it easier to manage your expenses. It lets you access your Visa credit card transactions via desktop browser or mobile app so you can track spending and stay on budget — at work or on the go. Free up more time to run your business.

For more information, visit https://usa.visa.com/run-your-business/small-business-tools/cards/visa-business-reporting.html

Sign up today!

Registration is required to access these services. To get started, go to: register.businesssolutions.visa.com

You can only cancel a payment if the person you sent money to hasn't yet enrolled with Zelle®. To check whether the payment is still pending because the recipient hasn't yet enrolled, you can go to your activity page, choose the payment you want to cancel, and then select Cancel This Payment. Fees may apply. Refer to our Services and Fee Schedule for Personal Accounts for details.

If the person you sent money to has already enrolled with Zelle®, the money is sent directly to their bank account and cannot be canceled. This is why it's important to only send money to people you trust, and always ensure you've used the correct email address or U.S. mobile number when sending money.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

You can use the app to set up direct deposit, so your teens’ paychecks are automatically deposited into their Greenlight account. Also, keep in mind that getting a first job is the right time to help your child open their first checking account and continue to teach them money management skills.

Account alerts are real-time and will be sent to you as soon as possible after the transaction has occurred.

- Mobile App - Set up and receive Account Alert push, email, and text notifications.

- Online Banking - Set up and receive email and text notifications. Please note that you can also set up a "quiet time" for your text and email alerts by clicking the Manage Delivery tab in Alerts.

Existing Customers

Existing North Shore Bank customers with personal accounts should log into Online Banking to open their new account. It will save you time, and the process will be more efficient.

New Customers

New North Shore Bank customers will need to provide the following information for the primary account owner to open a new account online:

- Email Address

- Complete Name

- Current Home Address, including City, State, and Zip Code

- Date of Birth

- Primary Phone Number

- Social Security Number

- Driver's License or other Government-Issued Identification

- Employer/Income Information

- The routing number and account number at your existing bank, or a debit or credit card number, to fund your new account

You will also be asked to answer questions regarding your expected account activity, including cash deposits/withdrawals and wire transfers.

Joint Account Owners

If you are opening a joint account online, the following information is needed for the joint owner:

- Email Address

- Complete Name

- Current Home Address, including City, State, and Zip Code

- Date of Birth

- Primary Phone Number

- Social Security Number

- Driver's License or other Government-Issued Identification

- Employer/Income Information

Beneficiaries

If you are adding a beneficiary, the following information is needed for the beneficiary:

- Complete Name

- Current Home Address, including City, State, and Zip Code

- Date of Birth

- Social Security Number

- Relationship to Account Holder

If you use your HELOC to consolidate higher-rate credit cards, your credit score may increase. If your balance on credit cards is relatively high compared to the credit limit available and you use your HELOC to pay down those cards, your credit utilization ratio will improve and in turn so will your credit score.

Learn about the Credit Utilization Rate and how it affects credit score from Experian.

Note that a HELOC balance is not part of your credit utilization ration because it is secured by your home. When applying for credit, a financial institution uses your FICO score (credit score used most often by lenders) which excludes HELOCs from credit utilization calculation.

When you apply for a HELOC or any loan, your lender will perform a hard credit inquiry. You score may decrease slightly, but the impact diminishes over time.

Learn about HELOCs and Credit Score from Experian.

Staying in control of your debit card is easier than ever. Our powerful card controls offer you an all-in-one dashboard for managing your North Shore Bank debit card and how it is used, viewing your transactions, and staying informed.

- Activate your card and manage your PIN

- View spending by category, monthly trends, and location

- Easily lock and unlock your card

- Restrict purchases to location, merchant categories, or transaction types

- Set up alerts based on transaction type, merchant category, or even spend limit

- Set travel plans

- Report your card lost or stolen

My Credit Score uses the Vantage Score 3.0 scoring model and pulls your credit profile from Trans Union. There are additional credit factors we consider when reviewing your loan application by using a FICO scoring model. The use of different scoring models is why you see a difference in your scores.

No scoring models are identical, but are directionally the same. If your score goes up based on your credit activity in My Credit Score, you might see an increase in the scores we pull for loan applications as well.

In order to use Zelle®, the sender and recipient's bank accounts must be based in the U.S.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

If you have lost your credit card, please call 866-552-8855 (Elan Financial Services) as soon as possible.

If you have lost your debit card, please contact 888-437-0103 as soon as possible.

Both of these numbers can be reached 24/7.

You will receive your text (SMS) verification code from 720-80. Please make sure you’ve entered the entire 4-digit secure code that was sent to you from this number. To have a new code sent, click on Send a New Code within the Enter Verification Code prompt.

As a reminder, do not share this four-digit code with anyone.

Follow these instructions to enroll in eStatements for Business Online Banking.

Contact North Shore Bank's Customer Support by email or by phone at 877-672-2265.

View our Business Account Opening Checklist to find out what you'll need to provide prior to opening a Business Banking account.

To help prevent overdrafts from occurring, we offer Overdraft Protection, which will automatically transfer funds from another North Shore Bank account that you own to cover the balance. Learn more about this service or visit your neighborhood North Shore Bank branch to sign up today. Overdraft and other account-related fees can be found on our Personal Accounts Fee Schedule or Business Accounts Fee Schedule.

You can set up bills to be automatically paid using Bill Pay.

Making bill payment fast, free, and (almost) fun!

Our free personal online bill pay service is available for all North Shore Bank checking customers who use Online Banking or the Mobile App that want to save the time, hassle and postage costs of paying bills by mail.

What's in it for you:

- Free personal online bill payment service

- Eliminates all or most check writing and saves you money on postage

- Pay anyone or any company, from the kid that mows your lawn to the utility company

- Eliminate more paper mail with eBills and eStatements

- You must have a North Shore Bank checking account and Online Banking or the Mobile App

- Take a tour of Bill Pay's benefits

To sign up for Bill Pay, simply log into Online Banking or the Mobile App to get started

We offer Debit Rewards* on our Standard and Platinum Debit Mastercard® where you earn points with every purchase that can be redeemed for cash back, gift cards, and more.

For credit card rewards, we offer a variety of cards that provide you with opportunities to earn rewards and other perks.

* Participation in Debit Rewards requires using the Mobile App or Online Banking and accepting the terms and conditions to register your card.

You can view your past check orders through the Deluxe check reordering system. To log in, enter North Shore Bank's routing number (275071356), your checking account number, and your zip code.

Once you've logged in, select "My Orders" from the upper-right of your screen and your order history from the last five years will be displayed.

To change the default card in your digital wallet, select the card that you would like to make the default and select “set as default”.

Yes, each request will be reviewed differently, decisions will be made based each loan itself (term, rate, value).

Mobile Deposit can process checks payable to you, in U.S. dollars from Personal, Business or U.S. Treasury checks.

Message and data rates may apply when using the Mobile App.

Once you sign up and create an account with our online loan payment service, you will be able to scheduling recurring payments.

No, we do not offer student loans but in some circumstances a home equity line of credit may be your best option.

When you finally come upon the house of your dreams, fast loan approval and a quick close can often determine whether you’ll be the one proudly moving into that new home.

At North Shore Bank, our mortgage team is proud to deliver fast, local decision-making and industry leading turnaround times. But you can do a lot to accelerate the closing process, too.

Try these suggestions:

- Get pre-approved online. Obtaining pre-approval often takes just a few minutes, but it can save a week or more once you’ve made your offer and begun the closing process.

- Gather documentation early. Learn which documents you’ll need for closing and track them down now, so you won’t be waiting anxiously later.

- Be complete. Our loan underwriters will need every last page of documentation (even the blanks) to establish your complete financial record. When in doubt, include it.

- Get your gift early. If a family member is helping with your down payment, deposit it in your bank account more than two months before you apply.

- Be honest. Omissions on the initial application are the #1 reason for delays, so be upfront about problem areas. We’re here to find and close a loan for you – not to judge you.

- Avoid big changes to your finances. Don’t apply for new credit, get a car loan or make big purchases. Also, avoid a job change if possible. It can raise red flags that slow your loan.

- Communicate quickly. Commit to checking your phone regularly, setting email alerts or doing whatever it takes to be responsive.

- Set a timeline with your seller. If your offer is accepted and the seller must fix certain issues, get it in writing with a mandatory completion date.

Working closely with North Shore Bank can help you move in ASAP, so contact us today or call 877-672-2265 to get other tips for a speedy closing.

We offer two Health Savings Account options. Both are interest bearing HSA checking accounts that include a free Debit Card and Mobile App or Online Banking access to easily manage your account.

Learn more and compare Health Savings Account options.

*Greenlight Select families can earn monthly rewards of 1% per annum on an average daily savings balance of up to $5,000 per family. To qualify, the Primary Account must be in Good Standing and have a verified ACH funding account. See Greenlight Terms of Service for Details. Subject to change at any time.

It cannot be used at an ATM. We do not recommend using it for recurring purchases like memberships or subscriptions because the new card information will need to be updated when your physical card is activated.

It is typically a checking account opened to pay health-related expenses with tax-free funds.

Learn more and compare Health Savings Account options.

Lease payments cannot be made through the online loan payment service.

Ordering checks online is fast and convenient. Plus you'll get instant confirmation of your order, and you can check your order's status online anytime.

There are several ways you can order checks:

- Log in to Online Banking (web-based); select the Reorder Checks link.

- Order directly through Deluxe. To log in, enter North Shore Bank's routing number (275071356), your checking account number, and your zip code.

- Mail or bring your check order form to your nearest North Shore Bank office.

Your cost for checks will vary depending on the style, type, and quantity you order. You can view pricing after logging in to Deluxe.

Within the Mobile App and Online Banking, you can access active personal accounts including savings, checking, CDs, and loans.

Learn more about Online Banking or the Mobile App.

Message and data rates may apply when using the Mobile App.

While your Mobile Deposit may be processed within minutes, later the same day, or by the next business day, the availability of the funds deposited is subject to the Bank’s funds availability policy.

All check deposits made through Mobile Deposit are subject to verification and final approval. Mobile deposits received and approved before 5:30 p.m. CST on a business day are generally available the next business day. New accounts have different availability schedules. For details on the Funds Availability Policy, please refer to the Deposit Account Agreement.

Message and data rates may apply when using the Mobile App.

Within Online Banking or the Mobile App, you can view images of your cleared checks. Simply click the check icon in the transactions listing to view the front and back of your cleared checks.

You can also filter your transactions to only display those which contain checks, allowing you to get to the right information quickly.

* It may take 3 or 4 days after the check has cleared to be able to view its image online.

North Shore Bank debit card customers can use ATMs located at any of our branches and at 33,000 MoneyPass ATMs nationwide for free. Find an ATM near you.

Digital wallets provide merchants with a device account number or token instead of a card number. This means your actual card number is never shared directly with the merchant and your details remain safe.

You may view our interest rates at any time. You can also set up a rate alert to be notified when mortgage rates change.

Yes. We are proud to offer a foreign currency exchange service. Please come into one of our nearby offices to convert your U.S. dollars. Rates and fees will be determined at time of service.

Find a North Shore Bank office, Video Teller or ATM near you

Customers using a North Shore Bank debit card are not charged ATM fees for transactions at any North Shore Bank ATM or any one of 33,000 MoneyPass Network ATMs nationwide.

Use our ATM & Branch Locator to locate an in-network ATM near you.

If you use your North Shore Bank Debit Card at an out-of-network ATM, North Shore Bank will charge a $3 fee, and you may also be charged a fee by the ATM owner.

Customers with a checking account that comes with a Platinum Debit Card receive two free out-of-network ATM withdrawals per account per statement cycle. You may still be charged a fee by the ATM owner.

North Shore Bank offers a Business Debit Card Reward program and when a Business signs up for the Easy Savings program, you will receive an automatic rebate posted to your card’s account when you use your North Shore Bank Debit Mastercard at any of the participating merchants.

Existing and new customers can open personal checking, savings, and money market accounts.

Existing customers can also open Certificates of Deposit.

We ask that you schedule an appointment at your nearest branch to open the following types of accounts:

• Any account for a minor (under the age of 18)

• Certificates of Deposit if you are a new customer

• Health Savings Accounts (HSAs)

• Individual Retirement Accounts (IRAs)

• Trust Accounts

• Custodial Accounts

• Business Accounts

New customers click here to get started.

If you have a personal deposit account or loan with North Shore Bank, log into Online Banking to open your new account. You will save time and the process will be more efficient.

If you’d like to open a business account, please contact a North Shore Bank Business Banker.

Your 8 or 10-digit account number can be found by clicking on the “eye” near your shortened account number in our Mobile App and within Online Banking. You can also find your account number on your paper statements, eStatements, on the bottom of your checks (the second set of numbers), or you can visit a neighborhood North Shore Bank office.

Temporary passwords in Business Online Banking last for 180 Days.

To start using Zelle® at North Shore Bank, you must be enrolled in Online Bill Pay. If you are not already enrolled in Online Bill Pay, you can enroll by logging in to the Mobile App or Online Banking (web-based). Locate the Online Bill Pay tab and follow the instructions to complete the Online Bill Pay enrollment steps.

Already enrolled in Online Bill Pay? Follow these steps to start using Zelle®:

- Log in to the Mobile AppFootnote 1 or Online Banking (web-based)

- Select "Send Money with Zelle®"

- Accept Terms and Conditions

- Select your U.S. mobile number or email address and deposit account

1 Mobile network carrier fees may apply.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Mobile Banking – Under the Quick Links menu, choose the My Credit Score link, agree to the Terms & Conditions and submit their permission to enroll.

NOTE: When you enroll in the Mobile App for the first time, you will be prompted to provide your full social security number to authenticate your credit profile. You will only be asked for this information during enrollment and will not be prompted again when accessing the My Credit Score dashboard in the future.

Online Banking - You will see a widget next to your accounts dashboard. Simply click the widget, agree to the Terms & Conditions and submit your permission to enroll.

Recurring Payments are those payments that happen repeatedly on a schedule, for example, streaming subscriptions, cellular bills, or other monthly bills you pay with your debit card.

Card on File is a list of merchants who store your debit card information for future purchases, like online retailers or delivery apps.

You can access a list of your Recurring Payments and Cards on File within My Card Manager.

RV, Boat, Camper or Auto Loan

You can change your due date after you have satisfied the first payment of your loan contract. Please contact Customer Support at 877-672-2265 to get started.

Mortgage Loan

The option to change your due date is not available.

Home Equity Line of Credit (HELOC)

The option to change your due date is not available.

Current customers can open a new checking, savings, money market, or Certificate of Deposit within the Mobile App or Online Banking. In the Mobile App, log in and select Open an account listed under Quick Links. Or within Online Banking, log in and select Open An Account, then Open Checking, Savings, or CD.

New customers can open a new checking, money market, or savings account online in just a few minutes. Get started now.

For those who prefer the human touch, stop by any branch or go online to schedule an appointment.

Message and data rates may apply when using the Mobile App.

Mortgage Loan

1098's for the previous year are sent out in January. For a duplicate 1098, contact Customer Support at 877-672-2265.

Home Equity Line of Credit (HELOC)

Please contact Customer Support at 877-672-2265.

RV, Boat or Auto Loan

Loans that are not collateralized by real estate do not automatically receive a 1098. If you would like us to prepare a statement, please contact Customer Support at 877-672-2265.

View instructions for adding your debit card to the digital wallet (Apple Pay, Google Pay or Samsung Pay) on your mobile device.

No, your North Shore Bank debit card will be automatically updated within My Card Manager.

For your convenience, you can use My Card Manager to activate your new card and manage your PIN.

First, verify with other accountholders that they did not initiate the transfer. If they did not, contact Customer Support.

*Subject to Apple Pay and Google Pay age requirements.

You can send, request, or receive money with Zelle®.

- To get started, log into North Shore Bank's Mobile AppFootnote 1 or Online Banking (web-based) and select "Send Money with Zelle®" and you're ready to start sending and receiving with Zelle®.

- To send money using Zelle®, simply add a trusted recipient's email address or U.S. mobile phone number, enter the amount you'd like to send and an optional note, review, then hit "Send." In most cases, the money is available to your recipient in minutesFootnote 2 if they are already enrolled with Zelle®.

- To request money using Zelle®, choose "Request," select the individual(s) from whom you'd like to request money, enter the amount you'd like to request, include an optional note, review and hit "Request"Footnote 3. If the person you are requesting money from is not yet enrolled with Zelle®, you must use their email address to request money. If the person has enrolled their U.S. mobile number, then you can send the request using their mobile number.

- To receive money, just share your enrolled email address or U.S. mobile phone number with a friend and ask them to send you money with Zelle®. If you have already enrolled with Zelle®, you do not need to take any further action. The money will be sent directly into your account, typically within minutes.

1 Mobile network carrier fees may apply.

2 Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®.

3 In order to send payment requests or split payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®.

If you have already been set up to use Business Online Banking and are a signer on the account, please try resetting your password. If you wish to have access to your business accounts through Business Online Banking, please contact 1-800-270-7956 to speak with our Treasury Solutions Team to get set up or stop in at your local branch to get started.

Note: Only Signers on the account can request the set up of their account to Business Online Banking.

There are a few ways that you can claim your property before it is escheated:

- Mail back the claim letter we sent you, stating that you wish to claim your account

- Transfer your funds to different account with North Shore Bank

- Close your account

- Make a deposit to or withdrawal from your account

- Update your passbook

We will periodically send out survey requests to gather feedback on how we can improve our products and services. Legitimate surveys will be sent from the following email addresses:

- northshorebankcontact@northshorebank.com

- northshorebank@surveyinforma.com

- northshorebank@qemailserver.com

Important reminders:

- NEVER share your PIN (personal identification number) or one-time passcode.

- North Shore Bank representatives will never ask you for your PIN or request you to verify personal financial information via email.

If you suspect that you’ve received a phishing email claiming to be from North Shore Bank, please call 877-672-2265 to report it or to verify the message’s authenticity. Your security is our priority.

For information on account minimum requirements, please view the current Personal Accounts Fee Schedule or Business Accounts Fee Schedule.

Yes, you may stop in at any of our office locations for our Notary services. There is no charge for customers to use this service. Please bring along a photo ID.

Find a North Shore Bank office, Video Teller, or ATM near you

You may change insurance companies but you will need to let us know anytime changes are made to the insurance coverage. Before you make any changes please contact Customer Support at 877-672-2265 to see if there are any restrictions or limitations.

You can generally access your funds by the next business day after the day you made your deposit. However, we may delay your access based on other factors we determine at our discretion.

Message and data rates may apply when using the Mobile App.

Yes, North Shore Bank offers a reloadable prepaid card which offers flexibility for everyday spending. Learn more about our Prepaid Card today.

You are being prompted to enter your password prior to performing a transaction within the Mobile App as an added security step. This is in place for customers that log into their accounts using Touch ID (Apple iPhone) and is only required once per user session.

Message and data rates may apply when using the Mobile App.

Yes, but at maturity if you decide to reinvest in a North Shore Bank CD your new CD will follow North Shore Bank’s grace period which is a 7-day grace period.

Log in to your account on the Mobile App or Online Banking and select Pay Bills or Payments to get started.

Watch our Bill Pay video tutorial.

Message and data rates may apply when using the Mobile App.

For Mobile App users:

- Log in to your account and select the Cards tab at the bottom of the screen.

- Select your new debit card and click to add to Apple Pay or Google Pay.

- You will need to enter an authentication code that will be sent to you by text or email.

- Your card is now added to your digital wallet.

- You can add a PIN for purchases within the Digital Wallet.

- Your temporary card details, including the full card number, the temporary expiration date, and a temporary CVV can be viewed so you can use the card for one-time purchases until your physical card arrives in the mail. In the Mobile App, your card details are found under the Cards tab and then under Card details, select View Digital Card. You may be asked to confirm your identity.

- You will receive a text message from short code 66368. (This is from us and safe to open.)

- Click on the link in the text. Note that this link is good for 21 days.

- Authenticate yourself with the last four digits of your social security number and the one-time password sent to you by text or email.

- Then agree to the Terms and Conditions.

- Next you can select to add your card to your Apple Pay® or Google Pay™ wallet. You will need to sign in to your wallet on your device and accept the wallet terms and conditions.

- You can create a PIN by scrolling down. You will get a confirmation after your PIN is successfully set.

We have made it super easy to check your child's spending history.

- Navigate to your child's dashboard.

- Click on the Spending tile.

- At the top right, click on "History."

You then have the ability to filter the view to see spending history for the last 30 days, 90 days, or 12 months as well as grouping transactions by stores.

Mobile App users can find your temporary digital debit card under the Cards tab and can add it to your Apple Pay® or Google Pay™ wallet. You can also see your temporary card in your digital wallet.

If you do not use the Mobile App, you can access your temporary digital debit card by clicking on the link in a text message from short code 66368. (This text is from us and safe to open.) You will be asked to authenticate yourself and agree to the Terms and Conditions. Then follow the prompts to add your new card to your Apple Pay® or Google Pay™ wallet. This link is good for 21 days.

If you’re using your card to pay for a subscription or storing the card with a merchant, we recommend you wait until you receive your physical card to make those updates.

When your eBill trial ends, your eBill delivery will stop. If you would like to end your trial sooner, please contact our Customer Support at 877-672-2265.

Yes, North Shore Bank offers a reloadable travel card which offers convenience, whether you're traveling locally or abroad. Learn more about our reloadable Travel Card today.

All mortgage loans in excess of 80% loan-to-value will require an escrow account be established. Borrowers with a loan-to-value less than 80% may request to waive the escrow account requirement.

The easiest way to sign up for direct deposit is to present your payroll department with a completed Direct Deposit Enrollment Form. It will have all the information they'll need to get you started.

Your account number can be found on your eStatement, paper statement or checks (second set of numbers).

Your employer must start the direct deposit process, however, you can download a Direct Deposit Enrollment Form to expedite the process.

You can authorize direct deposit of your payroll, Social Security, retirement, Veteran's Administration benefits or almost any recurring deposits.

With direct deposit, your check is automatically and safely deposited into your account. On payday, your money is right where you need it.

For information on account minimum requirements, please view the current Personal Accounts Fee Schedule or Business Accounts Fee Schedule.

Yes, if your card number or expiration date has changed you will need to update the card in your digital wallet. Please delete the old card from the wallet app.

To help prevent overdrafts from occurring, we offer Overdraft Protection, which will automatically transfer funds from another North Shore Bank account or home equity line of credit that you own to cover the overdrawn balance.

Learn more about this service or visit your neighborhood North Shore Bank branch to sign up today.

Stay up-to-date with your account with North Shore Bank Account Alerts. You can set up email notifications for your checking and savings account balances, plus find out when a check has cleared.

In Online Banking:

- Navigate to Settings > Security and Alerts > Alerts.

- Use the Manage Alerts tab to choose and customize the alerts you want. You will also choose the accounts you would like the alert placed on and what email address or phone number you want them sent to.

- View a demo of Account Alerts.

To submit a secure email, log into Online Banking and click on the Messages link toward the top of the page. From here you are able to compose a secure message and review messages that have been sent to you.

Please contact our Customer Support area by email or by phone at 877-672-2265.

When you enroll with Zelle® through the Mobile AppFootnote 1 or Online Banking (web-based), your name, the name of your bank, and the email address or U.S. mobile number you enrolled is shared with Zelle® (no sensitive account details are shared - those stay with North Shore Bank).

When someone sends money to your enrolled email address or U.S. mobile number, Zelle® looks up the email address or mobile number in its "directory" and notifies North Shore Bank of the incoming payment. North Shore Bank then directs the payment into your bank account, all while keeping your sensitive account details private.

1 Mobile network carrier fees may apply.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

For information on account fees, please view the current Personal Account Fee Schedule.

You can also manage your email notifications by navigating to the Resources Tab, selecting “Profile Settings” and change your preferences under Email Notifications.

Money sent with Zelle® is typically available to an enrolled recipient within minutes1.

If you send money to someone who isn't enrolled with Zelle®, they will receive a notification prompting them to enroll at a participating financial institution. After enrollment, the money will be available in your recipient's account, typically within minutes1.

If your payment is pending, we recommend confirming that the person you sent money to has enrolled with Zelle® and that you entered the correct email address or U.S. mobile phone number.

If you're waiting to receive money, you should check to see if you've received a payment notification via email or text message. If you haven't received a payment notification, we recommend following up with the sender to confirm they entered the correct email address or U.S. mobile phone number.

Still having trouble? Please contact North Shore Bank Customer Support at 877-672-2265.

1 Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®.

To send or receive money with Zelle®, both parties must have an eligible checking or savings account. Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Our Business Mobile App can be installed and used on an Apple or Android smartphone or tablet. To install the Business Mobile App on a tablet:

- Search for North Shore Bank Business Banking in the App Store.

- When the app results appear, change the device-type from iPad Only to iPhone Only. This will present our Business Mobile App to you for installation.

- Install the app and log into your account.

Because you'll be using the mobile app on a tablet, certain functions, such as changing the screen layout from portrait to landscape, are not available.

North Shore Bank can help you with all your financial needs. There really is no limit to the number of accounts you can have. As long as you continue to meet the requirements to open an account.

Find a North Shore Bank office, Video Teller or ATM near you

Your cost for checks will vary depending on the style, type, and quantity you order. You can view pricing after logging directly in to Deluxe. To log in, enter North Shore Bank's routing number (275071356), your checking account number, and your zip code.

There is no cost to use a Digital Wallet, however, an active data plan with your mobile carrier is required. Based on your wireless plan, additional message and data charge may apply.

You can make a loan payment to a different financial institution by using Bill Pay within Online Banking or the Mobile App.

There are several ways to change your personal information on file with North Shore Bank:

- Log in to Online Banking (web-based), go to Settings, then Profile

- Stop by a nearby office and meet with us personally. Bring along a photo ID, such as a Driver's License, for identification.

- By Mail - Send the completed Address Change Form to the address provided on the form

Loan amounts with a loan-to-value greater than 80 % require an escrow account for the payment of real estate taxes and insurance. Borrowers with a loan-to-value less than 80% may request to waive the escrow account requirement and pay these items themselves with the lenders' approval.

Yes, anybody can pay off the loan, although the title rights and/or responsibilities are solely of the party listed on the title and loan, unless otherwise specified.

For loan payoff information please contact Customer Support at 877-672-2265.

Yes, North Shore Bank offers gift cards which are great options for any occasion. Learn more about our Gift Cards today.

Enrolling in eBills is simple. Log in to your account our Mobile App or within Online Banking. From the Bill Pay page, choose from a list of Billers that offer eBills (indicated by the eBill icon). Just click the eBill icon next to the Biller name and follow the on-screen prompts to complete enrollment.

- Open your Greenlight app. From your Parent Dashboard, you should see a notification prompting you to activate your child’s card.

- Tap on the notification and input the card's expiration date in the app to activate it.

- Next, visit your child's dashboard by clicking their square at the top of your Parent Dashboard.

Most transactions must be disputed within 60 days of the date of your statement on which the error appeared. If you did not provide your account information to the merchant in question and suspect that your information was stolen, contact Customer Support immediately.

When you log on, you will see the number of new eBills, statements, and notices you’ve received. You will also receive a reminder email to notify you of new eBills in your account mailbox if they have not been viewed within four days of delivery.

For information on Wire Transfers please contact Customer Support at 877-672-2265.

Many homeowners refinance with North Shore Bank to reduce monthly payments, slash years off their loan term, get cash out and save many thousands of dollars in interest.

Refinancing your home often makes financial sense if:

- You can save at least a point or two off your current interest rate

- Your credit score has improved and you qualify for a lower rate

- Your financial situation has changed and you need lower payments – or you can now afford larger payments

A good place to start is by checking our rates and comparing them to your current mortgage. You might end up pocketing big savings over the life of the loan, or owning your house free and clear much sooner. Use our refinancing calculator to assess potential savings and break-even points.