It pays to know the differences between simple and compound interest and how these can be advantageous or disadvantageous for you in various situations.

When borrowing money, odds are you’ll be paying interest on that loan. It pays to know the differences between simple and compound interest and how these can be advantageous or disadvantageous for you in various situations, depending on the type of loan you’ve taken out.

Simple interest

Simple interest is based on the principal amount, or original borrowed amount, of a loan or deposit. The interest amount remains fixed throughout the duration of the repayment period. For example, if simple interest is charged at five percent on a $10,000 loan over a three year period, the amount of interest paid will be $500 each year, for a total of $1,500. Common examples of real-life simple interest loans are car loans, which are easy to calculate.

Compound interest

While simple interest lives up to its name, compound interest is more complex. “Compound interest accrues on the principal amount and the accumulated interest of previous periods; it includes interest on interest, in other words,” Steven Nickolas explains in an article for Investopedia. If the $10,000 loan described above involved compound interest rather than simple interest, the total interest paid after three years would be $1,576.25 instead, as the interest owed each year is calculated based on the original loan plus the interest paid in the previous year.

This also means that compounding interest scales significantly with frequent compounding periods, potentially even more so than with higher interest rates. “For every $100 of a loan over a certain period, the amount of interest accrued at 10 percent annually will be lower than interest accrued at five percent semi-annually, which will, in turn, be lower than interest accrued at 2.5 percent quarterly,” Nicholas writes.

Impact on loans

Odds are, financial experts or people you know have encouraged you to start saving for retirement while you’re young. This isn’t only because you have more time to put more money into your retirement, but also because compound interest enables you to save exponentially more money by starting earlier.

The same is true in reverse when repaying loans. The earlier you start, and the more frequently you repay a loan, the less money you will have to pay over the total period. In fact, it is highly encouraged that you repay loans whenever possible, as debt compounded over the years can spiral out of control.

“Pay off debts quickly and pay extra when you can,” Justin Pritchard advises in an article for TheBalance.com. “Paying the minimum on your credit cards will cost you dearly because you’ll barely make a dent in the interest charges and your balance could actually grow.”

As with all loans, you should always seek the lowest interest rates you can find, but keep in mind that even with a low rate, compound interest can quickly make a loan overbearing to repay if you just give it the time. “If you have student loans, avoid capitalizing interest charges and pay at least the interest as it accrues so you don’t get a nasty surprise after graduation,” Pritchard says. “Even if you’re not required to pay, you’ll do yourself a favor by minimizing your lifetime interest costs.”

Compounding is a powerful force that can work for you if you invest early and regularly. If you are at the early part of a loan that has to be repaid with compound interest, you can save money by paying it back early and increasing the frequency of your loan repayments.

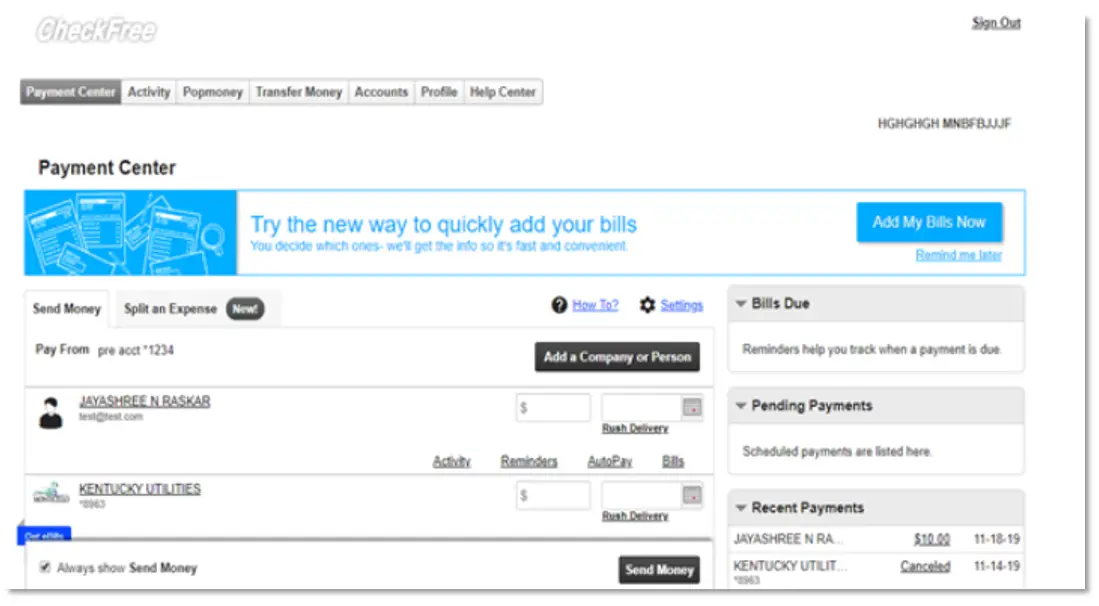

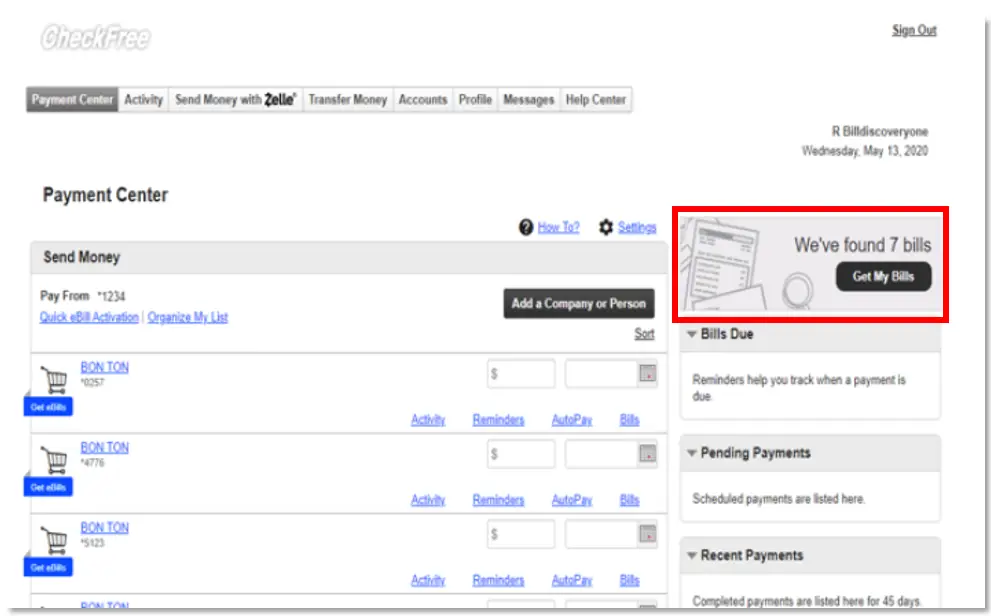

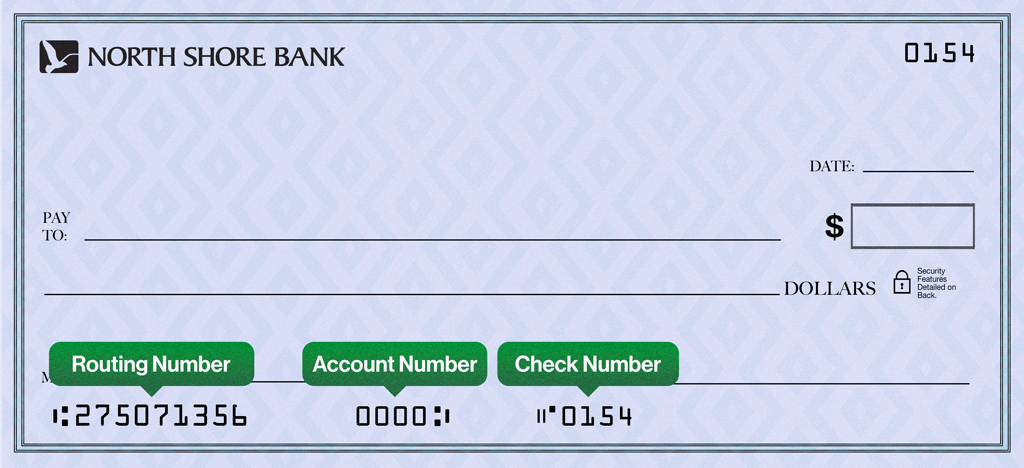

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card.

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card. Click on the three vertical dots alongside the blue “Pay” button

Click on the three vertical dots alongside the blue “Pay” button