It’s true: Good credit is important.

Having a good credit history shows that you reliably repay borrowed money. That is reassuring to many lenders you will encounter in the future and makes you a more desirable customer. Here are a few ways good credit can give you a leg up and even save you money.

Lower Interest Rates - When you apply for a loan, like a mortgage or a credit card, the higher your credit score, the lower the interest rates that will be available to you. As a result, you’ll save with lower payments.

Qualify for Credit Card Deals - A good credit score will help you get approved for a credit card, but it will also let you choose a better card with low interest rates, rewards, and cash back. Using these card perks will help you save money and keep your credit score up when you continue to pay on time and maintain a low or no balance.

Easier Approval to Rent - A landlord will want to see your payment track record by looking at your credit. A better score makes you a more favorable tenant. A low credit score may mean a higher security deposit or require a co-signer on your lease.

Better Car and Home Insurance Rates - Insurance companies will look at your credit score when you apply. Your premiums could also be higher or lower, depending on your score.

Skip Utility Deposits - A utility company may use your credit ranking to understand your payment performance. With good credit, they are more likely to go forward with little issue. If it’s low, they could require a deposit or letter of guarantee that says a friend or family member will pay your bill if you don’t.

You can stay on top of your credit score with North Shore Bank’s free resource and tracking tool, My Credit Score. See your score as often as you want, learn how to improve it, and more!

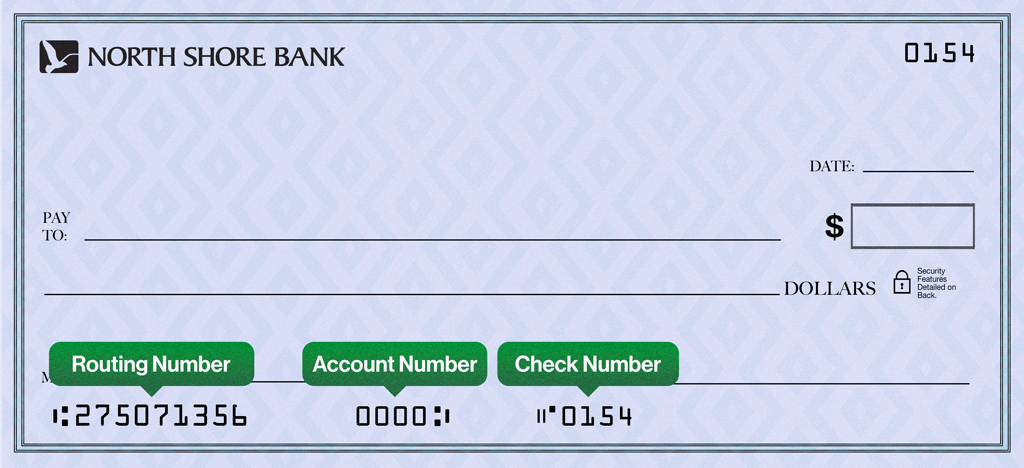

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card.

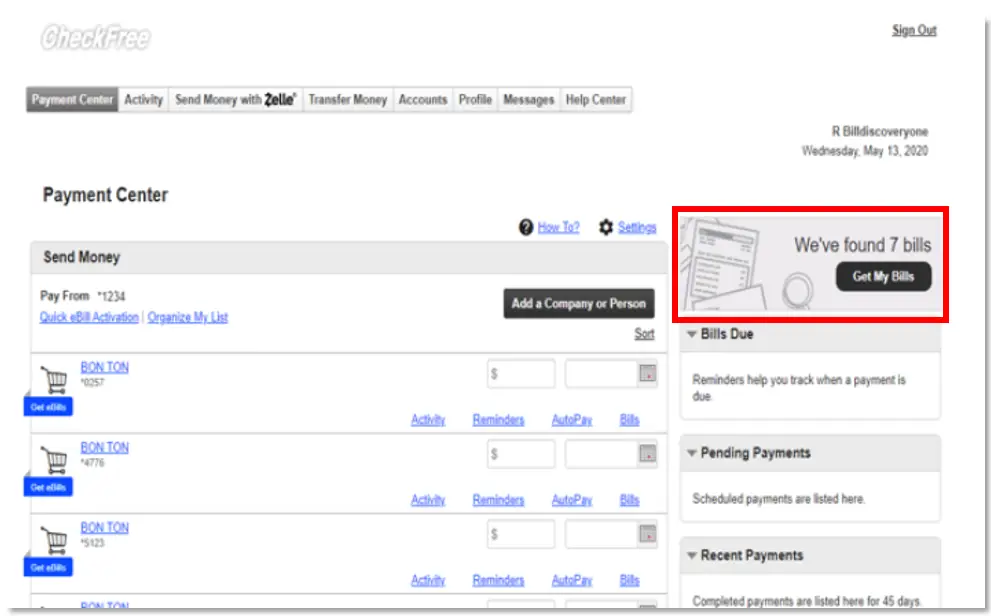

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card. Click on the three vertical dots alongside the blue “Pay” button

Click on the three vertical dots alongside the blue “Pay” button