A great way to reduce the stress of talking about money is to discuss things frequently with your partner. Don’t wait for a financial crisis to talk! Some couples find it best to schedule regular discussions about money, while others take a more casual approach.

However you and your partner decide to do it, make sure that it is a frequent topic in your relationship.

Here are some tips on how to have these important conversations:

1. Discuss goals and values – not just dollar amounts.

Money means different things to different people. Talk with your spouse about your long-term goals and what money means to you. It’s very likely that you’ll have different views about what money means, and talking about it will help you get on the same page.

Even if your long-term goals are aligned, it is possible that your short-term values will still be different. Someone who loves clothes may think that a pair of $175 shoes are a steal, while their partner—who shops exclusively at thrift stores—may disagree.

These are not solely issues of dollar amounts, so much as they are about what each partner feels is important. Understanding what your partner values and making any necessary adjustments together will help you work out your budget and your finances.

2. Avoid criticism, contempt, defensiveness and stonewalling.

Actually talking about money can be difficult. But disagreements about money don’t have to lead to lasting relationship problems.

Prominent family scientist and couples therapist John Gottman lists four common problems that couples should avoid while communicating:

Criticism: Criticizing is not the same as voicing a complaint or a critique. For example, a complaint may be, “I’m feeling concerned about your IKEA spending yesterday. I thought we agreed to consult each other if we were going to spend more than $200.” A criticism, on the other hand, could look like, “You overspent again. Why do you always do that? You are so selfish!” One addresses the issue at hand, while the other attacks the partner’s character.

Contempt: While criticism attacks your partner’s character, contempt assumes a position of moral superiority over them. Contempt can be behaving disrespectfully, being sarcastic, using mimicking body language, scoffing, calling them names, etc. “You bought another dumb video game? Are you kidding me?” Attacking a partner from a position of perceived relative superiority is terrible for a relationship, and will make discussing finances nearly impossible.

Defensiveness: When we feel like we’ve been accused, we often fight back. “I deserve something special. It’s not my fault you aren’t any fun.” However, it doesn’t work—because it’s really a way of blaming your partner and makes healthy conflict management impossible.

Stonewalling: Stonewalling is when one partner shuts down, withdraws, and stops responding to the other. But ignoring the issue will not fix it. When we start to stonewall, we may not be able to think or respond logically and kindly. If that becomes the case, it is important to request a break in the conversation and pick it up later — to allow your body to calm down.

If you catch your money conversations sliding into these bad habits, know that you have the power to turn them around and create a positive environment for discussing finances.

3. Work together to keep track of your joint expenses.

Finding out your balance is as easy as checking your account on a mobile app, on your computer, or at the ATM. But tracking expenses isn’t about realizing that your balance is $300 less today than it was yesterday. It’s knowing where the $300 went and whether that spending is in line with your plan.

For some people, seeing how much they’re spending on clothing and shoes on a monthly basis is enough to help them slow down the shopping. And for some couples, the information is enough to make them realize they need to reduce large fixed expenses, which might mean moving to a smaller apartment or leasing a less expensive car.

Although it may be a difficult conversation, comparing your spending with your partner’s may be a huge step forward in getting on the same financial page. This is especially true if you’re sharing household expenses, with each partner responsible for specific categories.

4. Lastly, make a plan to fix problems that arise.

If it turns out that one of you, or both of you, are not following the spending plan you agreed on, what’s next?

The best first step is to rethink the amounts you’ve allocated to various categories. For example, if transportation costs are higher than you planned, and there’s no feasible way to reduce them, can you agree to cut back what you’re spending on something else?

Fixed expenses are the most difficult to adjust. For example, probably the only way to reduce your rent is to move, and that involves costs of its own. But other costs that are variable, like food and entertainment, are fair game.

In a partnership, financial conflicts are bound to happen. But using these tips, you can face them together as a couple to keep your relationship and your financial future strong.

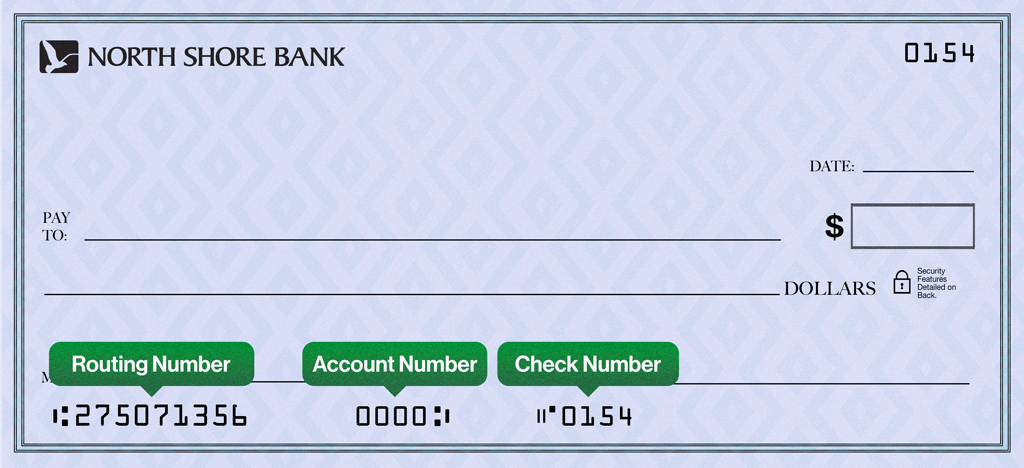

Interested in a North Shore Bank Checking or Savings Account?

Browse more of our financial literacy resources by clicking here.

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card.

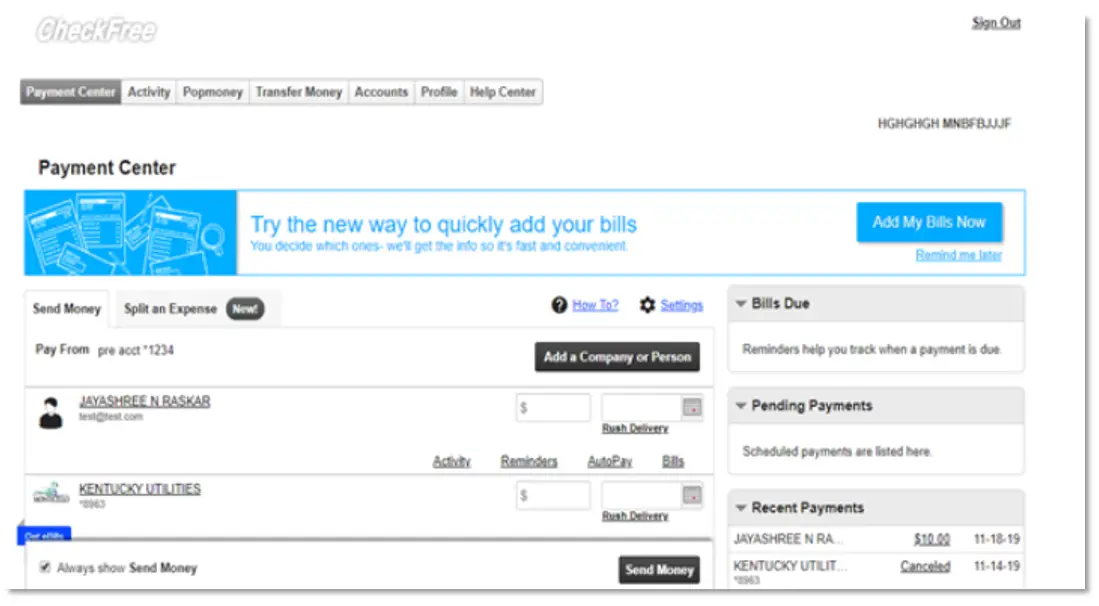

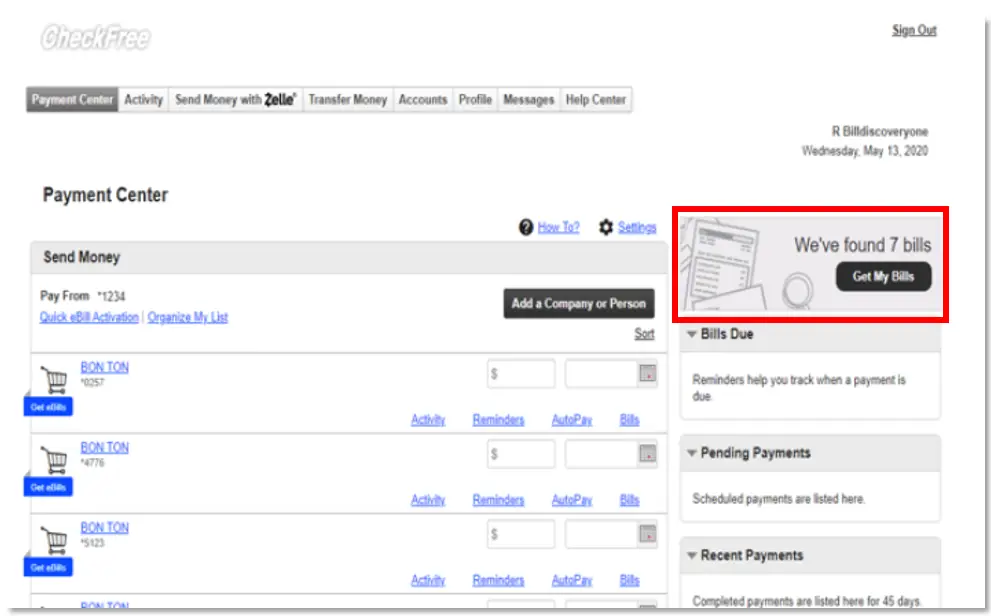

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card. Click on the three vertical dots alongside the blue “Pay” button

Click on the three vertical dots alongside the blue “Pay” button