That’s because you, like many people, will be responsible for supporting yourself during the 20+ years you can expect to live after you retire. To do that, you need a source of income that will stretch further than the safety net of Social Security and be more reliable than winning the lottery.

Some—but increasingly fewer—employers offer traditional pensions, which pay you retirement income based on your final salary and time on the job. Instead, most employers offer you the opportunity to participate in a salary reduction plan, such as a 401(k).

If your employer offers a 401(k) or 403(b), it’s usually the most painless way to set aside money for the future.

All you have to do is agree to have a percentage of your gross income to be withheld each pay period. Participating in one of these plans has a few possible advantages:

- Any tax-deferred contributions reduce your current income taxes since they’re subtracted from your income before tax withholding is calculated

- Contributions to a tax-free Roth 401(k) or 403(b) aren’t deductible. But when you withdraw after age 59½, your earnings are tax-free (as long as your account has been open at least five years.)

- Many employers match a percentage of the contributions you make, building your retirement funds even faster.

- Any earnings in your retirement plan account accumulate tax deferred. That means the earnings are reinvested to increase the base on which additional earnings can accumulate, a process called compounding.

Time is money.

The more years that you add contributions to your plan, and the more years that any earnings increase your principal, the larger your account balance has the potential to grow.

Of course, there are no guarantees about either the rate or the regularity of the earnings. They may be awesome one year and dismal the next, or they may go through longer, but still alternating, periods of growth and decline. That’s the reality of investing. Having time on your side means that bumps in the road, like a period when investment prices go down and your account value shrinks, don’t have to be fatal.

401(k) plans are the most common, and best known, employer sponsored salary reduction plans. But they’re not the only ones.

If you work for a not-for-profit organization such as a school or college, a hospital, a cultural institution, or a charitable organization, your employer may offer a 403(b) plan, which operates in much the same way as a 401(k).

Similarly, the plan a state or municipal government offers may be a 457 plan, while federal government departments and agencies provide a thrift savings plan (TSP). And if you work for a small company—one with fewer than 100 employees—you may be part of a SIMPLE plan, an acronym for Savings Incentive Match Plan for Employees.

The rules differ slightly for each type of plan, and even among plans of the same type. But all offer the opportunity for tax-deferred earnings.

If your employer does not offer a 401(k), or if you simply want to increase your investing, there are also individual retirement accounts (IRAs).

There are two types of IRAs: a traditional IRA and the Roth IRA. The main difference between them is when you pay taxes.

A traditional IRA is tax deferred. This means that you can contribute money before it's taxed, and you don't owe taxes on those contributions or your earnings until you withdraw the money. It's likely that you will be earning less when you begin to withdraw from your IRA, which means that you may end up being in a lower tax bracket and paying less overall in taxes. If you qualify, you may also be able to deduct your contributions to your IRA on your federal income tax return, which can lower how much you will need to pay.

A Roth IRA is not tax deferred, which means you owe taxes when you contribute the money to the account. But that means you won't have to worry about paying them later and your contribution can grow tax-free. Withdrawals of contributions and earnings are tax-free if your account has been open at least five years, and you’re at least 59½.

Trying to decide which IRA is for you?

Remember: Whether you save for retirement through a 401(k), traditional IRA, Roth IRA, or other plan – the longer money is invested, the more it has the potential to grow.

The most practical solution may be weekly or monthly contributions, perhaps as direct debits or electronic transfers from your checking account. There are no guarantees when you invest this way, any more than there are when you invest a lump sum. You could lose money, especially in the short term. But if your investments do well, adding to them regularly can give your account value a real boost.

If you are close to retirement and trying to decide when to start receiving benefits, get more information.

Interested in talking with one of our financial advisors?

Browse more of our financial literacy resources by clicking here.

1 Securities and insurance products are offered through Cetera Investment Services LLC (doing insurance business in CA as CFG STC Insurance Agency LLC), member FINRA/SIPC. Advisory services are offered through Cetera Investment Advisers LLC. Neither firm is affiliated with North Shore Bank or its related companies. Individuals affiliated with Cetera firms are either Registered Representatives who offer only brokerage services and receive transaction-based compensation (commissions), Investment Adviser Representatives who offer only investment advisory services and receive fees based on assets, or both Registered Representatives and Investment Adviser Representatives, who can offer both types of services.

Investments are: • Not FDIC insured • May lose value • Not financial institution guaranteed • Not a deposit • Not insured by any federal government agency.

Do not rely upon the information provided in this content when making decisions regarding financial or legal matters without first consulting with a qualified, licensed professional. Furthermore, while we have made good faith efforts to ensure that the information presented was correct as of the date the content was prepared, we are unable to guarantee that it remains accurate today. North Shore Bank expressly disclaims any liability arising from the use or misuse of these materials and, by visiting this site, you agree to release North Shore Bank from any such liability.

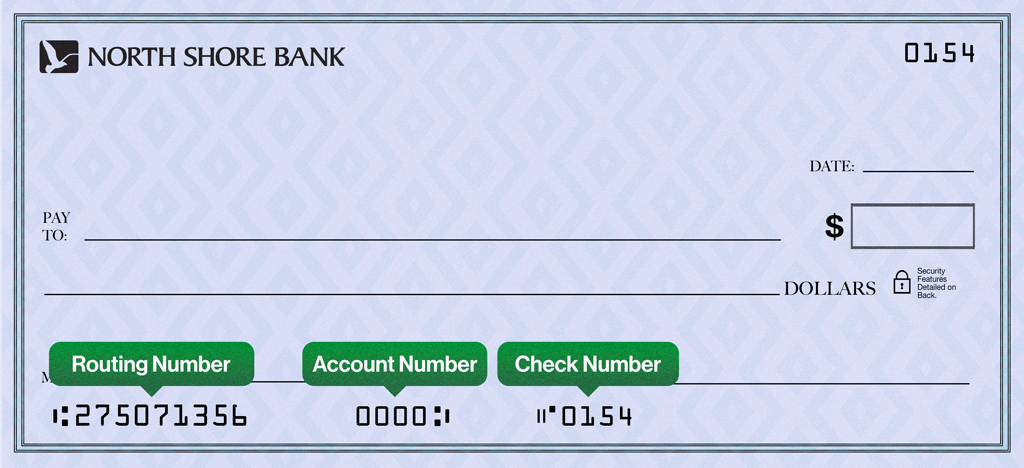

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card.

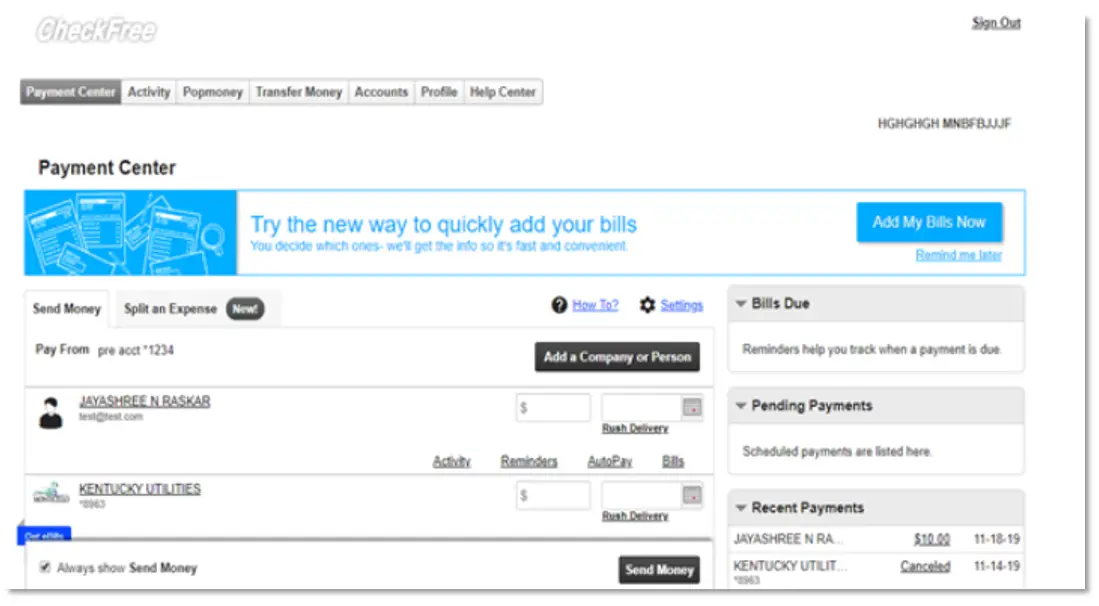

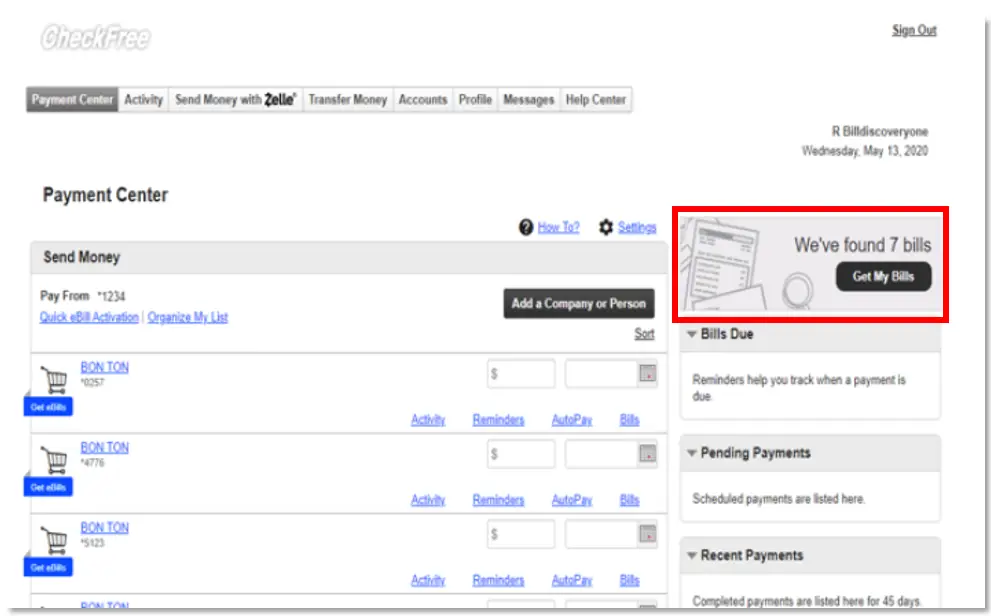

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card. Click on the three vertical dots alongside the blue “Pay” button

Click on the three vertical dots alongside the blue “Pay” button