Next comes the challenging (but rewarding!) work of maintaining it.

If there’s one thing homeowners know, it’s that owning a home comes with unexpected expenses – and those expenses often come at the most inconvenient times. A roof leaks, a water heater blows or a furnace fails in the middle of winter.

A home equity line of credit (HELOC) offers flexibility and peace of mind for homeowners.

A HELOC is a line of credit that allows you to tap into your home’s equity and borrow against it for home expenses when needed.

The line of credit is based on a percentage of the value of your home. The more your home is worth, the larger the line of credit. Of course, the final line of credit you receive will take into account any outstanding mortgages you might have at the time. This includes first mortgages, second mortgages and any other debt you have secured by your home.

Establishing a HELOC means that when stressful events arise, you’ll have a way to pay for them.

A HELOC allows you to transfer funds into your checking account with a few simple clicks of the mouse. You can breathe a sigh of relief knowing you have an immediate source of funds for unexpected financial needs or wants.

At North Shore Bank, many of our customers say they consider their HELOC another form of insurance, and they happily report their financial stress level is lower because they know they have some freedom and flexibility when needed.

Outside of emergencies, a HELOC can also help you improve your home and make your dreams a reality.

Making upgrades to your home can add value long-term, but they can be costly in the short-term. Whether you want to replace your floors, install new countertops or add on to give your family more room, a HELOC can make those improvements possible.

You can also use your HELOC to finance other large purchases – like finally getting a new car or helping a child pay for their wedding.

At North Shore Bank, a HELOC offers you flexibility in how you use it, and the option to convert a portion of it to a fixed amount.

With an interest-only HELOC, your monthly payments only include the accrued interest on the money that you've borrowed. Additionally, North Shore Bank offers conversion loans, so if you draw a balance on your line of credit, you have the option to lock in at a fixed interest rate.

Interested in a Home Equity Line of Credit through North Shore Bank?

In addition to HELOC, North Shore Bank also offers multiple Visa Personal Credit Card options to help you with these major life purchases. Learn more about credit cards through North Shore Bank.

Browse more of our financial literacy resources by clicking here.

Do not rely upon the information provided in this content when making decisions regarding financial or legal matters without first consulting with a qualified, licensed professional. Furthermore, while we have made good faith efforts to ensure that the information presented was correct as of the date the content was prepared, we are unable to guarantee that it remains accurate today. North Shore Bank expressly disclaims any liability arising from the use or misuse of these materials and, by visiting this site, you agree to release North Shore Bank from any such liability.

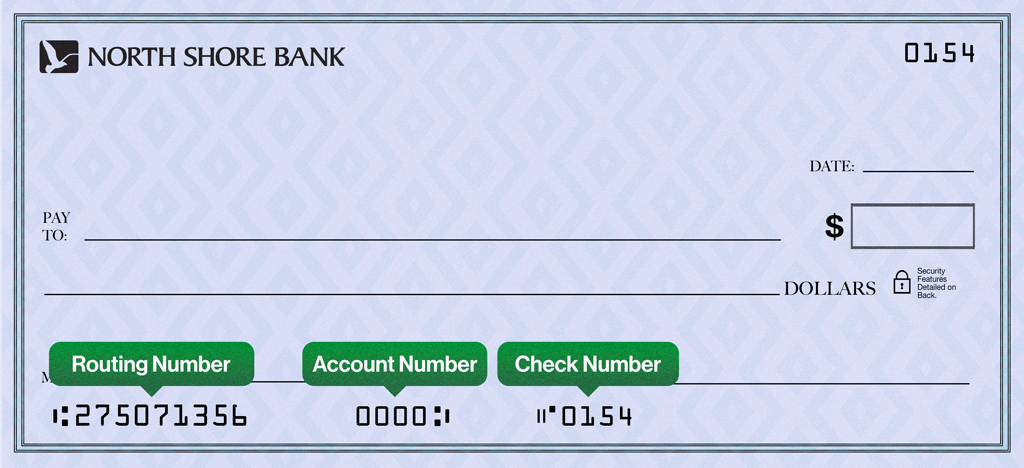

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card.

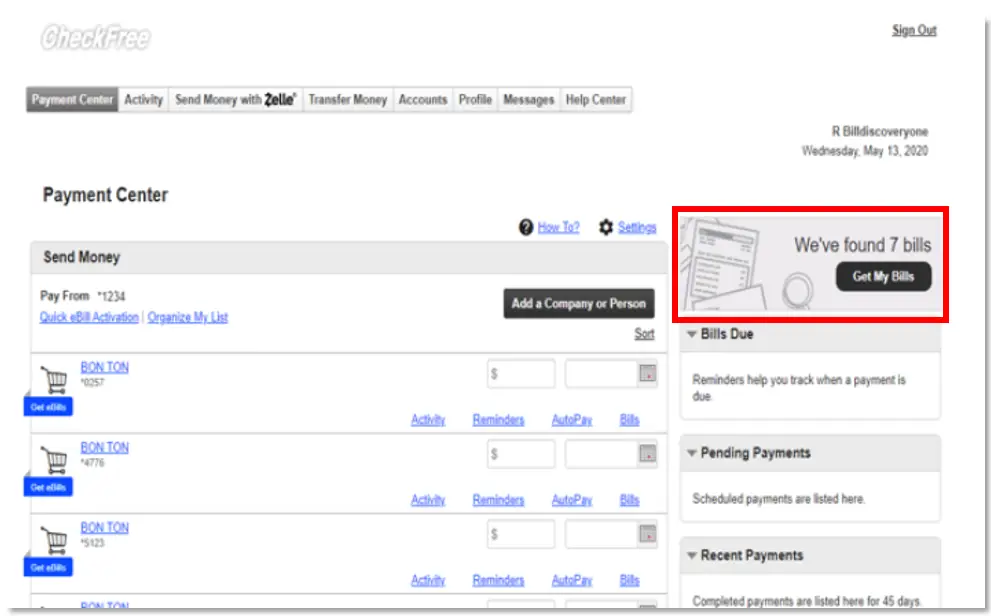

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card. Click on the three vertical dots alongside the blue “Pay” button

Click on the three vertical dots alongside the blue “Pay” button