One of the things that makes buying a home worthwhile is the fact that — unlike with a rental — the money you spend on it becomes an investment.

That’s why home insurance is so important. Without it, if your home is damaged or destroyed, you lose the place you live in as well as whatever it’s worth. But if you have insurance, you’ll be able to rebuild both your home and the financial security it provides.

Even if you don’t think insurance is a good idea, you’re stuck with it anyway. Lenders require you to have it. That way they’re protected from any loss, especially in the early years of a mortgage when most of the equity—and the risk—is theirs.

Home insurance works the same way renter’s insurance and other forms of insurance do.

You pay a regular premium for the privilege of being covered. If your home is damaged, you’re responsible for covering any repairs up to the amount of your deductible. After that, your insurance kicks in and reimburses you for as much of the damage as your policy allows. The larger the deductible, the less you’ll have to pay for each premium—but of course you’ll have to pay more out of your own pocket if your house is ever damaged. Plus, remember to consider coverage options for your home’s contents and possible natural disasters.

How Much Do You Need?

If you want to figure out how much coverage you should have, first you have to figure out the replacement value of your home. That’s what it would cost to repair or rebuild your home at today’s prices, including materials and labor. Insurers can help you appraise your home to find this value, but remember that it’s in their best interest to arrive at a high number. On the other hand, don’t be shocked at a number that seems higher than you expect, especially if you’re living in an up-and-coming area.

It’s wise to insure your home for 100% of its replacement value, and you may find that some insurers cap what they will cover at 20% to 25% above the insured value. You might add a rider to cover your living expenses while rebuilding takes place. And, if you own an older home, you might want a rider to cover the cost of meeting current building and wiring codes.

Make sure to check the details.

Many insurance companies offer to cover the market value of your home, which is the price you’d get if you sold it in the current market. Since market value includes the value of the land around your house—which rarely needs to be insured—you’ll be paying to insure a higher amount than you really need to.

And if you’re insuring your belongings, make sure they’re insured for replacement value, not cash value. The cash value of belongings is what you could get from selling them at the present time. And since expensive things like appliances depreciate over time, cash value is usually a lot less than replacement value. That means you’ll have to lay out money of your own if you want to replace destroyed or damaged items.

So while it can sometimes be a little more expensive to cover your house and belongings for replacement value, the protection it provides against the forces of inflation and the fluctuation of real estate prices is usually well worth it in the long run.

Take notes.

If your home is ever damaged, you’ll have a much easier time recovering money from your insurance provider if you’ve kept good records of your valuable possessions. Write down the purchase price and date, manufacturer, model, vendor, and the serial number of all your expensive items. Keeping receipts is a good idea too.

In fact, if you can record your possessions with photographs or video, you’ll be even safer. That way, if anything is damaged, you can shoot it again for comparison.

And of course, make sure to keep all of this documentation in a safe place—one other than your house. That way you’ll be able to get to it easily if anything happens to your house.

Don’t stop there!

As you think about insuring your home, also make sure that other areas of your life are covered, such as life and/or disability insurance. Even if you feel you are young, your job is secure or you’re in perfect health, it’s always smart to plan for the unexpected.

Interested in a North Shore Bank Insurance Product?

Browse more of our financial literacy resources by clicking here.

Do not rely upon the information provided in this content when making decisions regarding financial or legal matters without first consulting with a qualified, licensed professional. Furthermore, while we have made good faith efforts to ensure that the information presented was correct as of the date the content was prepared, we are unable to guarantee that it remains accurate today. North Shore Bank expressly disclaims any liability arising from the use or misuse of these materials and, by visiting this site, you agree to release North Shore Bank from any such liability.

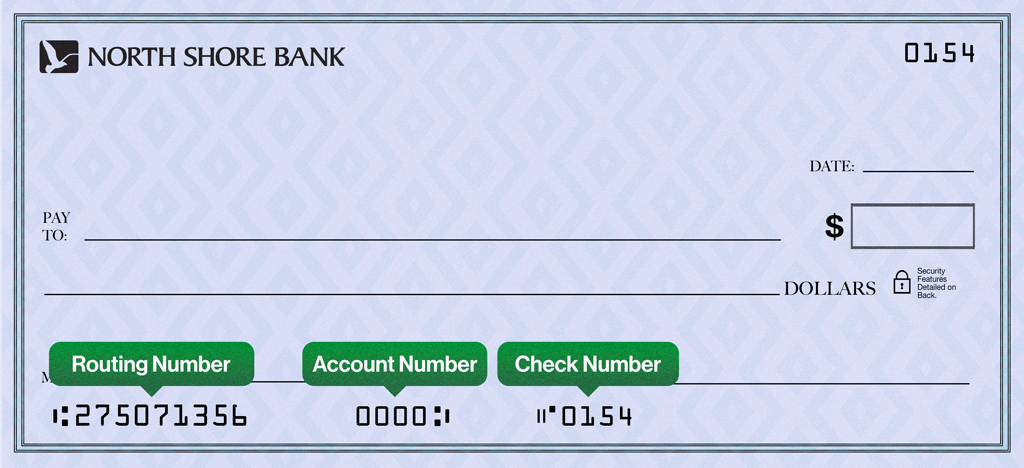

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card.

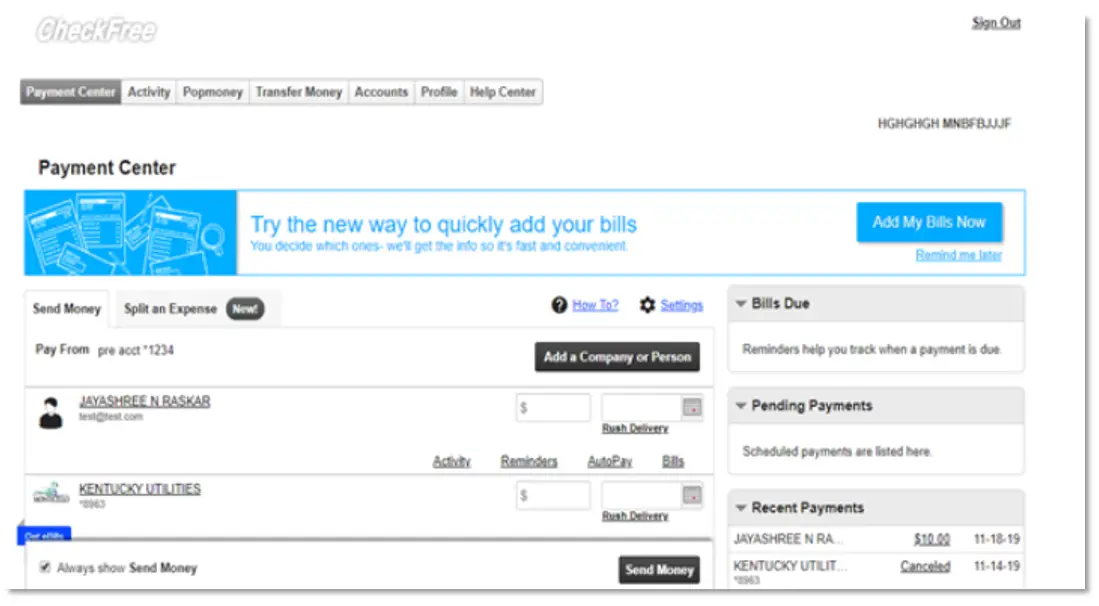

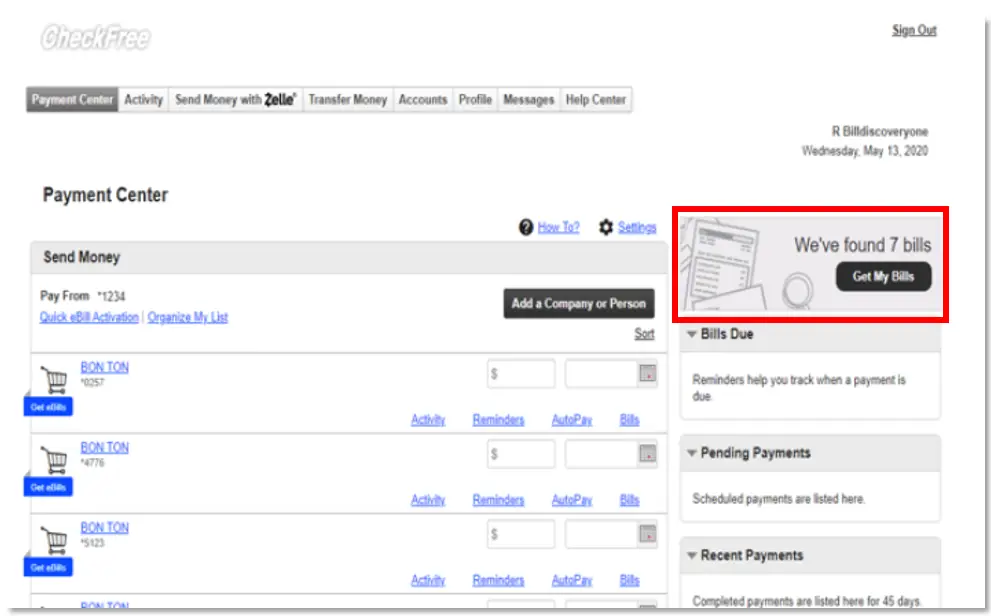

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card. Click on the three vertical dots alongside the blue “Pay” button

Click on the three vertical dots alongside the blue “Pay” button