The first thing you should remember is that it takes the same criteria to build as it does to purchase – Income, Assets, Credit and, of course, a home. It all has to work together.

Before you start excavating, it’s a good idea to understand the construction financing process:

1. Pre-Approval

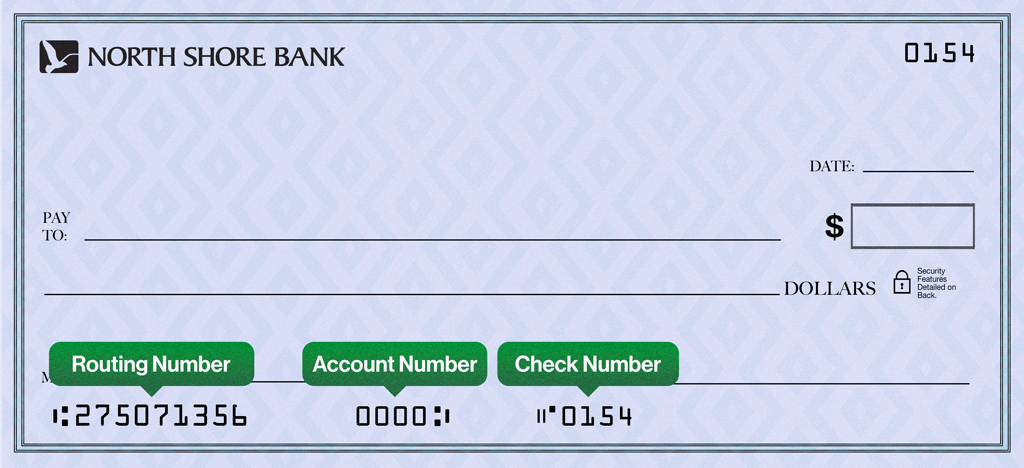

The first step is to get pre-approved on a new construction loan. Our lenders are happy to help you navigate this process. To get started, you can go online, stop by your nearest North Shore Bank office or Schedule an Appointment.

With an all-in-one construction loan, North Shore Bank makes financing your new home easy while saving you money with just one application, one closing, and one loan. With our construction loans, you don’t have to refinance at the end of construction. If you do choose to refinance, however, we have great options to meet your needs.

2. Look for Lots, Builders, and Upgrades

Once you have been pre-approved, you can find the perfect lot, research the best layout, and search for a builder. Consider your pre-approval amount and consider your budget very carefully. It’s important that you select partners that you trust.

When you’ve met with a builder, have a contract signed, and have found your perfect lot, it’s back to the bank!

3. Get your Loan

Meet again with your lender to take your pre-approval and officially make it your new construction loan.

Some of the basics of your new construction loan include:

- The build has to be done in 11 months

- Your payments are interest only on the draws that you’ve used during construction

- An appraiser will verify the value of your new construction before you build and upon completion

- A title company will ensure that you will be able to live in your new home

Once this has all been thoroughly vetted and you’ve gone through underwriting, you will close on your new construction loan.

4. Pay your Builder

The money gets to your builder through the title company. The title company acts as the eyes and ears of the project, ensuring that all of the work has been completed.

5. The Final Draw

After your home has been completed, the appraiser will go back out and confirm that what has been built matches the original plans and specs that were provided. Then, the builder will give you appropriate documentation and an occupancy permit so you can officially move into your dream home!

6. Move In!

At every step along the way, we’re here to help answer any questions you have. North Shore Bank is The Bank of You – so let us be your partner when you’re building your new home.

Interested in a North Shore Bank New Home Construction Loan?

Browse more of our financial literacy resources by clicking here.

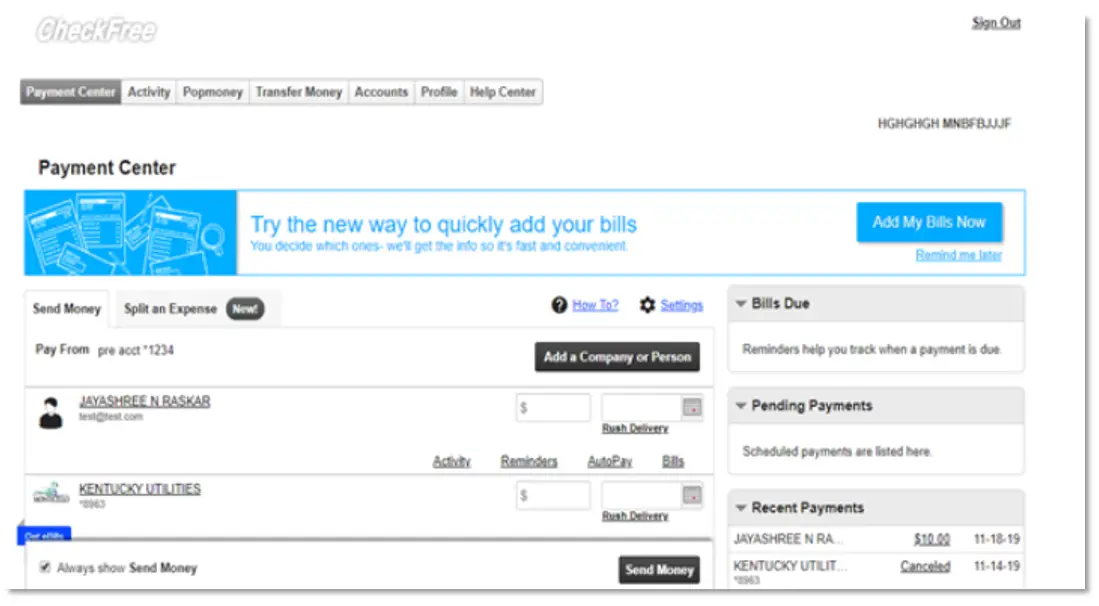

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card.

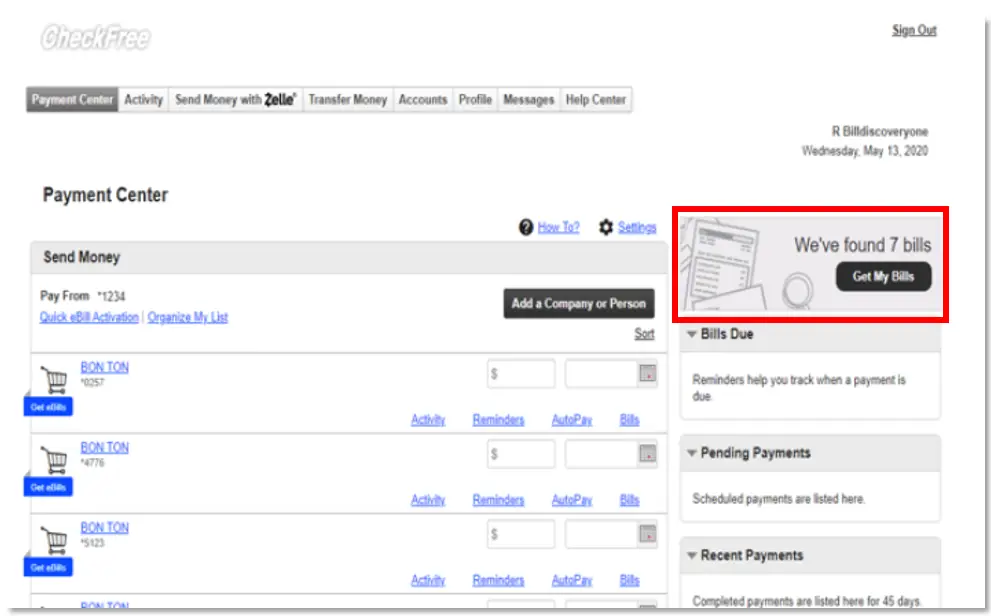

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card. Click on the three vertical dots alongside the blue “Pay” button

Click on the three vertical dots alongside the blue “Pay” button