For most people, their home is their largest financial investment and asset. Ideally – over time and with every mortgage payment made – the value you have in your home increases, which should translate to increased potential for profit when it comes time to sell. Despite inevitable economic ups and downs, it’s important to take the long view when considering your home’s eventual profit potential.

The 25-year average appreciation rate for homes in the U.S. is 3.9% (based on a 2019 report by Black Knight, Inc.), and while that’s great news increased value doesn’t just happen in a vacuum. Several significant factors that can help increase your home’s value are the real estate market, the state of the overall economy and the condition of your home.

The Economy

As we’ve seen recently, the housing market doesn’t always directly fluctuate based on the performance of the economy. Even throughout the pandemic, home property values have increased and buyer demand has been strong.

Lending rates have a big role to play in home values versus overall economic conditions. For the most part, home sales increase when mortgage rates are low. With reduced rates, the benefit to new homebuyers is two-fold: first, lower rates save money on interest over time; second, lower rates open the door to affording more home. In the Wisconsin Realtors Association January 2021 report, WRA President and CEO Michel Theo said, “Very low mortgage rates are fueling demand, and with such limited supply, it’s really driving up home prices…these are great rates, and homes are moving quickly, often with multiple offers, which can push prices above the asking price.”

The job market is another significant piece of the full economic puzzle. In short, job creation leads to an increased demand for homes because potential buyers have confidence in their ability to make payments over the long term. Property values correspondingly rise in areas of job growth as workers compete for homes in desirable neighborhoods.

The Real Estate Market

The perceived value of your neighborhood and the buying and selling of real estate near you can affect value of your home. Home demand and pricing can depend on a whole host of factors including:

- Inventory - When demand for homes in a desirable neighborhood is high, the basic law of supply and demand comes into play. Houses tend to sell quickly, limiting buyer options and leading to increased competition. “With mortgage rates being historically low we have more potential buyers looking to become homeowners, making it a sellers’ market in many areas,” says Laura Luedtke, an Appleton-based Realtor with Exit Elite Realty. “While it can be tempting to sell for that reason alone, many people are afraid to list their home for fear of not finding a new one. Any time a homeowner is considering whether to leverage the value of their current home to make an upward move, it’s imperative they do so with the guidance of a trusted lender and a trusted real estate partner.”

- Recent Comparable Sales – Home values are based on the sale price of what’s commonly referred to as “comps” in your area. Real estate agents use comps to help determine the selling price of a home; appraisers use comps when evaluating a home to determine its worth. In an active real estate market, buyers might engage in bidding wars and cause homes to sell for more than the asking price and for more than nearby homes did in the past. This causes new listings post at higher prices and perpetuates the upward cycle.

- The Neighborhood – There’s a reason you often hear “location, location, location” when it comes to real estate. Schools with a good reputation and a strong report card tend to increase the value of homes within district lines. Families typically want to send their children to quality schools, obviously, but those without school-age children might buy in a high-demand district to improve their chances of building and retaining value. Business is the other side coin to schools when it comes to desirable neighborhoods. Access to jobs and convenient shopping influence home-buying decisions. If new or improved retail outlets or trendy businesses are moving in, buyer demand increases and boosts property values.

The Home Itself

Even a booming economy and hot neighborhood might not overcome significant challenges with a home itself. When looking at the total value of your home, both the appraiser’s and buyer’s viewpoint are important when it comes to:

- Living Space – A starting point for overall value is the home’s size or usable square footage. In many cases, you can increase the value of your home by adding an addition, finishing the basement or utilizing an unfinished attic. Per square foot, bedrooms, kitchens and bathrooms add the most value.

- A Welcoming Exterior – The first thing a buyer sees is the exterior of your home. “Curb appeal” can be enhanced by updates to your home’s exterior lighting; adding or improving landscaping; painting or re-doing trim or siding; and much more.

- Property Age and Condition – When determining a home’s value, an appraiser will evaluate your home’s overall condition. Are repairs required before the sale? How old are major mechanicals? What’s the condition of your foundation and basement? On the other hand, buyers will make note of your home’s condition based on what they can see and will recognize the value in updated lighting and flooring; modern mechanicals; or a new roof, windows or garage door.

- Upgrades – Some home improvements do more to increase your home’s value than others. A new garage door, a fresh exterior paint, a new deck or adding stone veneer all have high potential for return on investment. Check out several more ideas in this recent article from Homelight about how to get the most bang for your remodeling buck when it comes to investing in your home’s value.

While there is no crystal ball that will tell you the price a buyer will pay for your home, paying attention to these factors and your local market helps prepare you for what's ahead. Speaking with a North Shore Bank Mortgage Loan Officer near you can also offer you a better understanding of the current environment. We’re here to help and invite you to contact us to get started.

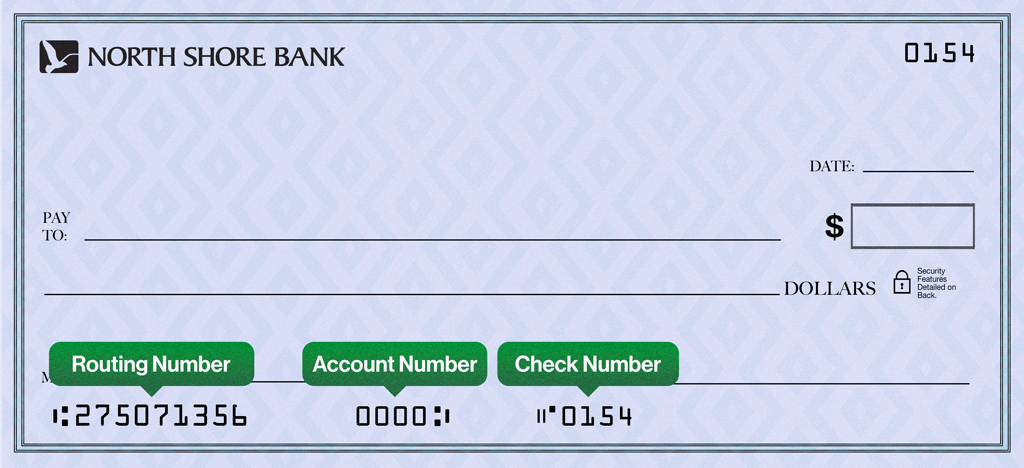

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card.

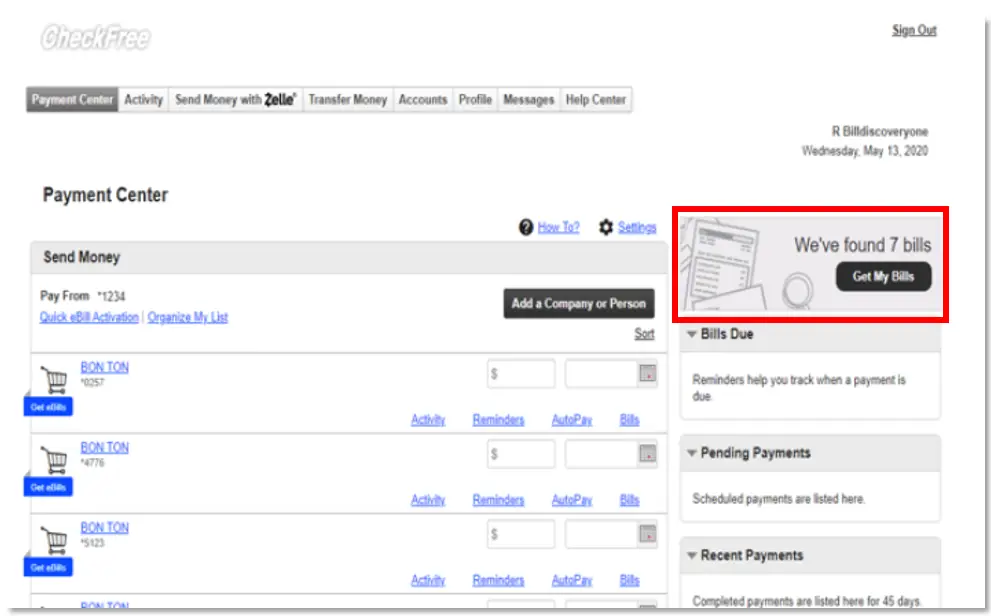

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card. Click on the three vertical dots alongside the blue “Pay” button

Click on the three vertical dots alongside the blue “Pay” button