If there’s one thing of which homeowners can be sure, it’s that owning a home comes with unexpected expenses – and that those expenses often come up at the most inopportune times. A roof leaks, a water heater blows or the furnace fails on the coldest day of the year … or just in advance of when the in-laws are expected to arrive.

The good news for homeowners is that establishing a home equity line of credit (HELOC) means these challenging events don’t have to be made more stressful by uncertainty about how you’ll pay for them. When you secure a HELOC through North Shore Bank, you can rest assured that you have easy, immediate access to draw on the value of your home.

Consider these four benefits:

1) Freedom from worry and flexibility at your fingertips

You don’t have to fear the unexpected because you planned for it. A HELOC allows you to transfer funds into your North Shore Bank checking account with a few simple clicks of the mouse. You can breathe a sigh of relief knowing you have an immediate source of funds for unexpected financial needs or wants. Many of our clients tell us they consider their HELOC another form of insurance, and they happily report their financial stress level is lower because they know they have some freedom and flexibility when needed.

2) A tool for consolidating and decreasing expenses

If you’ve ever used a credit card to pay for a major expense in an emergency, you know how frustrating it is to be paying interest, often years into the future. In addition, if you carry balances on your credit cards from month to month, instead of paying $100 here and $200 there you can consolidate debt into a HELOC. In most situations you pay less overall interest and improve your monthly cash flow. Finally, for many of our customers who use their line for home improvements, a HELOC is a deductible item on your tax return. Check with your tax advisor to review your specific situation.

3) Improve your home and add value

Drawing on your home’s equity, a HELOC can be used for unexpected home repairs and more. While the line of credit is a great emergency resource for the unplanned new furnace or roof maintenance, other home updates may help increase the value of your property. Imagine your upgraded living space – refresh the look of your bathroom, install new kitchen countertops, replace the carpet with hardwood floor, or add on to give your family more room.

4) Live the life you want

Live your best life by financing other large purchases; take that long-awaited vacation or finally get that new car; or help your child pay for their wedding. A HELOC is a great way to help make your dreams a reality.

Life brings all kinds of worries balanced out by wonderful opportunities. You have enough to do without the added stress of trying to figure out how to juggle additional expenses and payments. Get in touch today so we explore how a North Shore Bank HELOC can benefit you and your family.

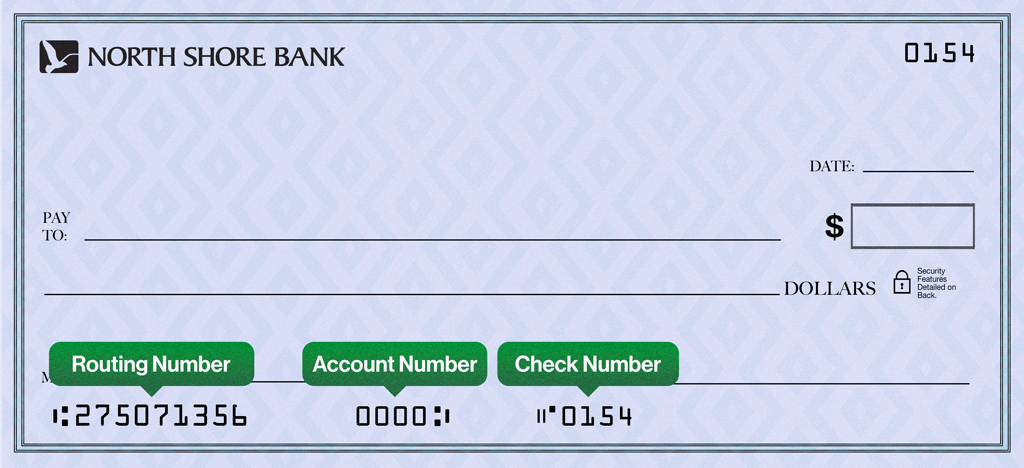

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card.

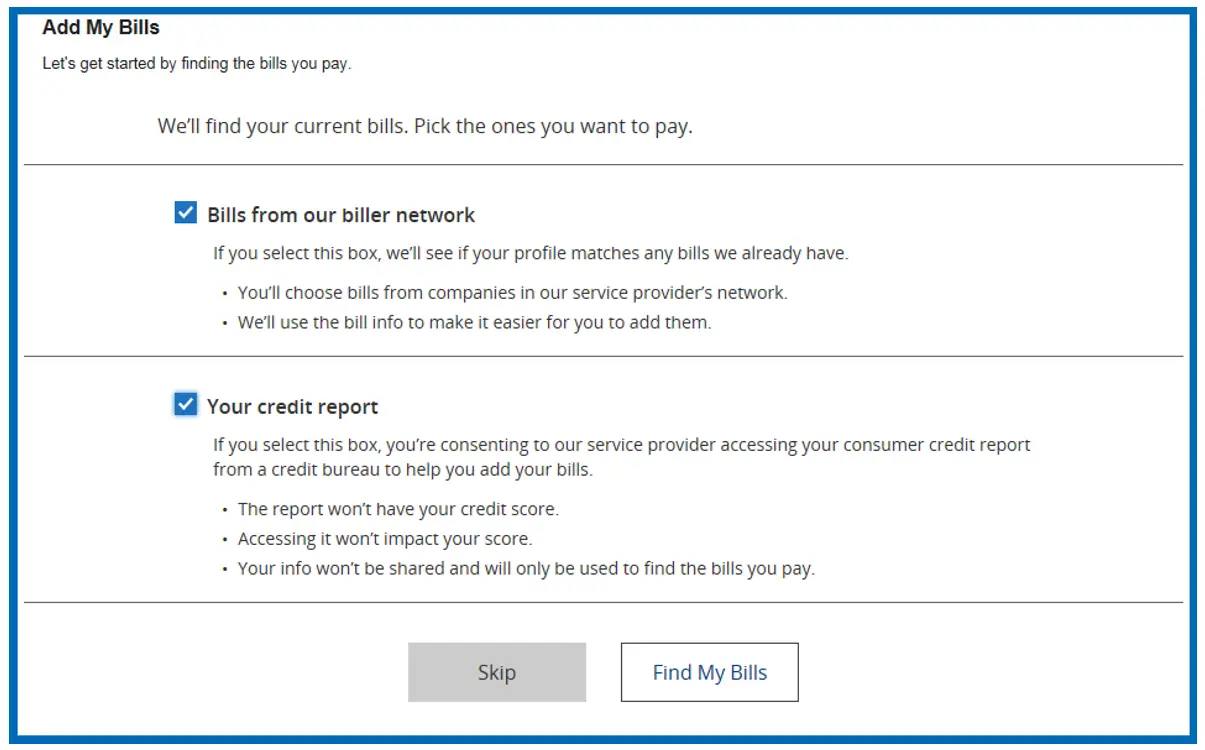

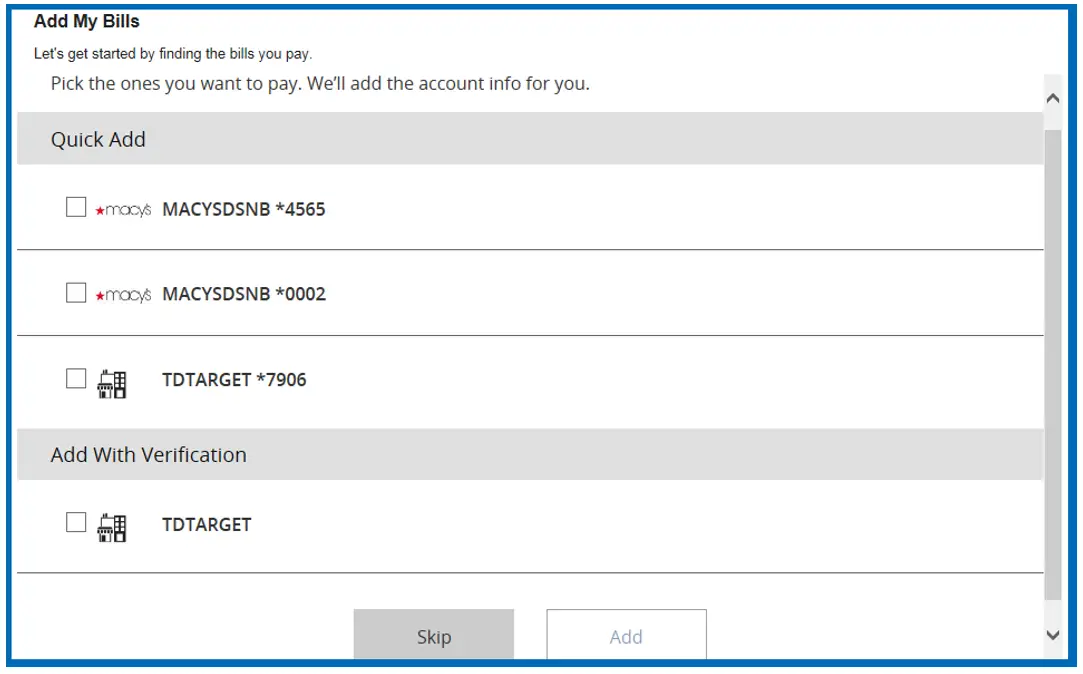

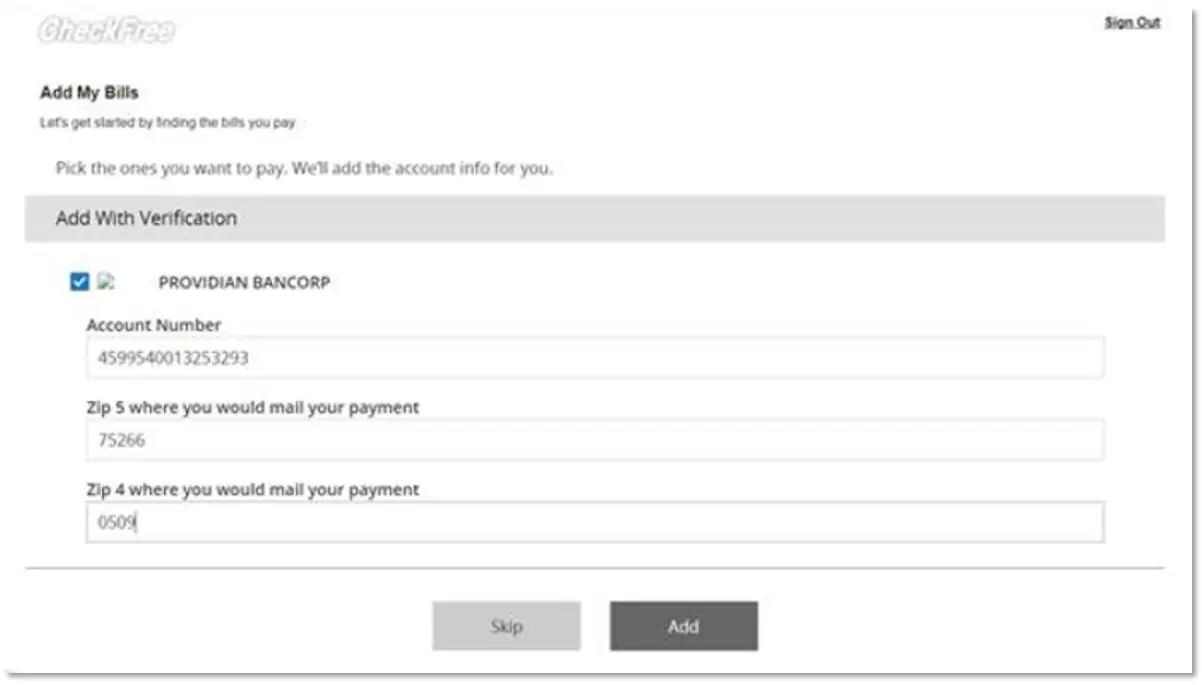

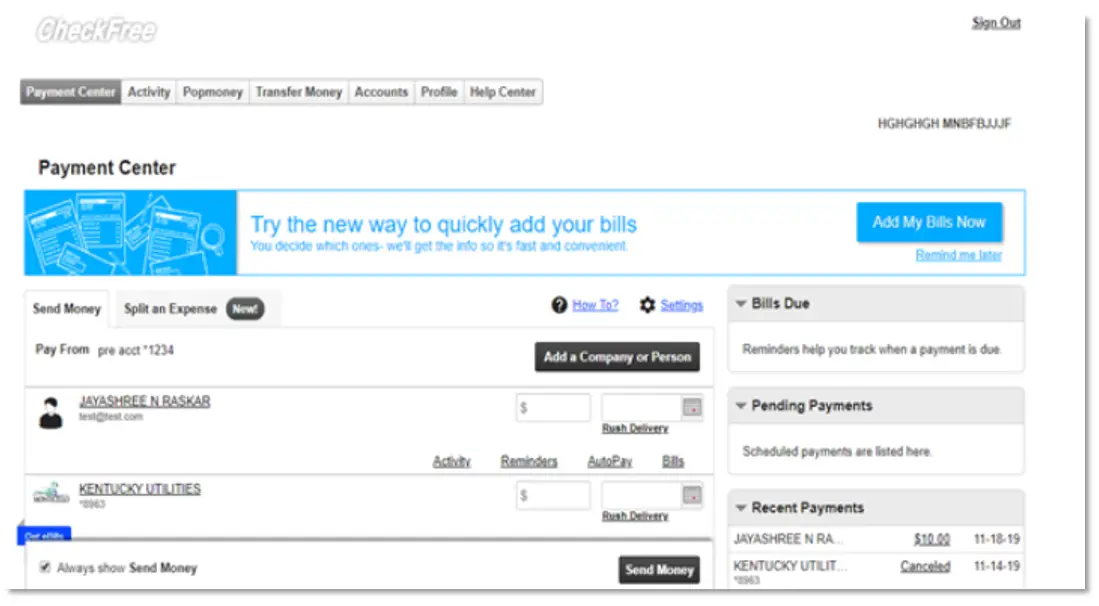

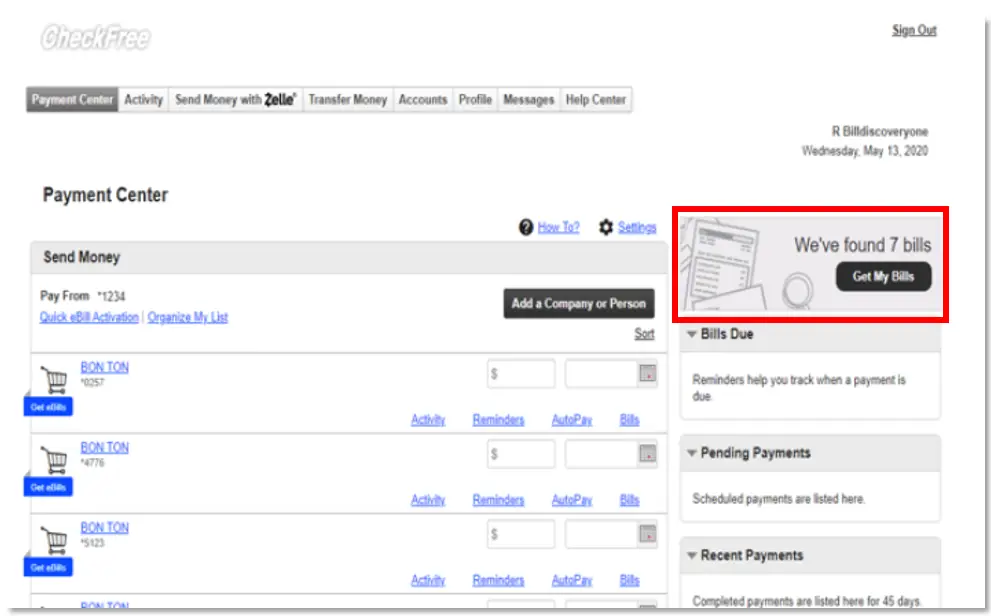

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card. Click on the three vertical dots alongside the blue “Pay” button

Click on the three vertical dots alongside the blue “Pay” button