Automatic and online payments by credit card are certainly nothing new. Especially in the wake of COVID, more and more businesses are further automating how they accept credit card payments or even moving to a completely cashless model. North Shore Bank can help guide businesses to the most secure and efficient solutions for accepting payments – whether from other vendors or from customers – for businesses of all shapes and sizes. What follows is a quick overview of online options and cashless considerations for businesses.

Automated payment options

- If customers still visit you on-site or in-store, “tap to pay” options – Apple Pay, Google Pay, Samsung Pay or even a Tap and Go card – eliminate the need for employees to physically handle cash or checks or another person’s plastic.

- Online ordering through a website works particularly well for businesses that offer curbside or prepaid pick-ups. Takeout food is currently a very common use for this, but it can also be customized for retail, ticket sales, and just about any other type of sales.

- Virtual Terminal allows businesses to invoice customers via email and include a secure payment link. Virtual Terminals can also allow the business to set up pre-payment methods for billing and invoicing customers at a later date.

Keeping costs under control

- We always recommend our business customers first consult with their credit card processor to gain a better understanding of how cards are processed. There might be simple adjustments available that can greatly reduce processing fees.

- Any business that takes credit cards is required to be PCI or “payment card industry” compliant. Processors often use PCI non-compliance fees as an expensive monthly reminder to prompt businesses to become compliant or maintain compliance. Again, your credit card processor should be able to help you avoid any costly non-compliance fees if you are proactive about it on the front side.

- There is a shift toward offsetting credit card processing costs through surcharging – which means customers agree to cover the processing costs or part of the cost by paying an additional fee/surcharge. If you choose to go this route, your North Shoe Bank team can help you understand regulations about when and where surcharging is allowed.

Ensuring Security and Fighting Fraud

- Chip-and-Signature and Chip-and-PIN are both Card Verification Modes (CVMs). Signature cards will require a signature to verify the transaction, while PIN cards will require a PIN – which is more secure.

- Another mode of verification is the CVM number, which is a 3 or 4 digit code on the back of a card. Merchants that accept online, mail-order, and telephone orders must be prepared to request the verification code when the cardholder is not present to validate a transaction.

As we continue to navigate life and business post-pandemic, it’s critical that businesses have the capability to do online and contactless payments. We are always here to help you evaluate the options and solutions that work best for you and your business to accepts payments in a way that is user-friendly, secure and cost-effective.

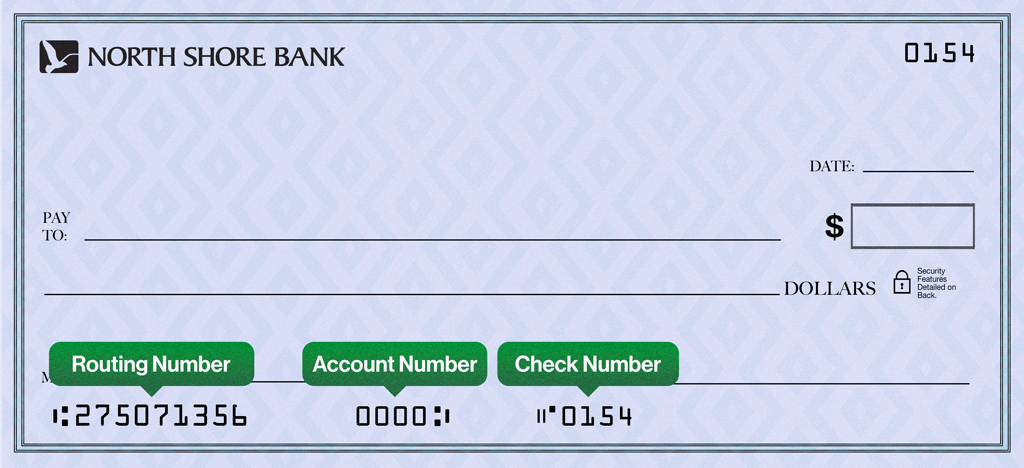

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card.

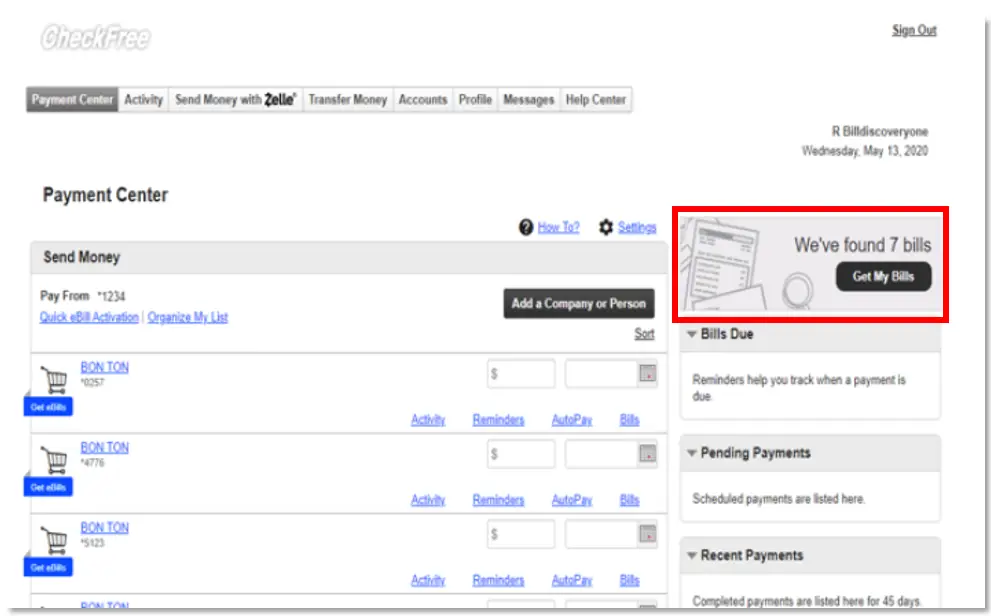

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card. Click on the three vertical dots alongside the blue “Pay” button

Click on the three vertical dots alongside the blue “Pay” button