The earlier we can teach children about earning interest versus paying it, the better prepared they will be to manage their own finances. Below are a few tips to help your children understand the value of smart saving.

Start at the Grocery Store

Use ordinary shopping trips as an opportunity to learn about savings. When you show good spending habits (use coupons, shop sales, compare unit pricing), take advantage of that opportunity to talk about savings. When finalizing your transaction, discuss the difference between cash, checks, debit and credit cards.

Set a Budget

Encourage children to distribute the money they have between sharing (10%), spending (30%) and savings (60%). Three separate piggy banks or labeled jars can make this easier.

Have Children Set Goals

Take advantage of a goal-setting discussion the next time your child asks for a particular toy. Consider taping a picture of that item on their piggy bank or bulletin board as an incentive to save their pennies.

Consider an Allowance

Experts differ on whether or not allowances should be tied to household chores. You might consider paying your children for chores outside of daily duties, such as washing the car or painting the fence. When giving allowances, give the money in denominations that encourages distribution between sharing, spending and savings.

Start a Family 401(k)

As your children save money, consider matching what they save. Or, reward them with an additional amount, just like a bank pays interest.

Caution About Credit

Alert children to the dangers of borrowing money and paying interest. If you do extend your child a loan, use a written IOU, establish a repayment schedule, and charge interest. Explain to children how to verify charges on a receipt and how to guard against credit card fraud.

Open a Savings Account

Take your child to the bank and open a savings account. Make regular deposits, and encourage children to use common sense before withdrawing from their account. Talk about how you save money, how you make it grow and how you spend it wisely.

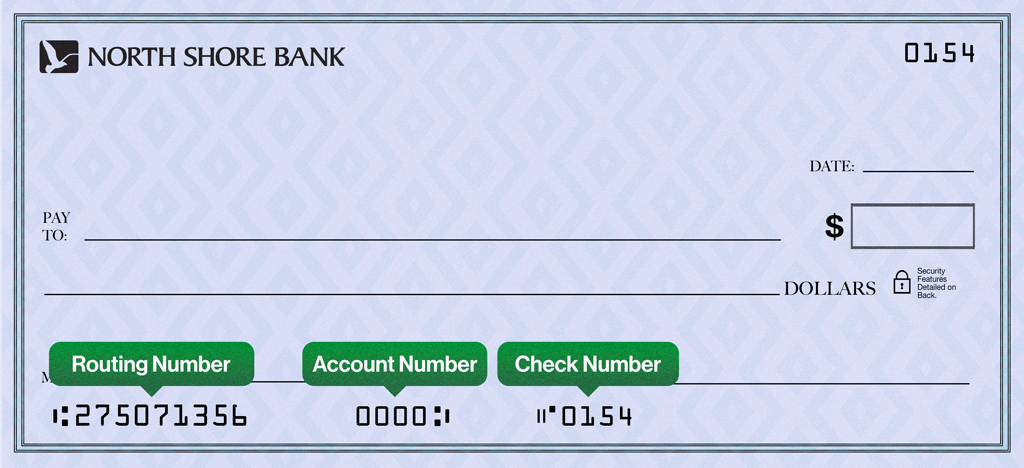

North Shore Bank can help you teach your kids to save with a Seymour Savings account, a special account for savers 12 years and under. Kids earn interest on their money and are rewarded for each deposit.

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card.

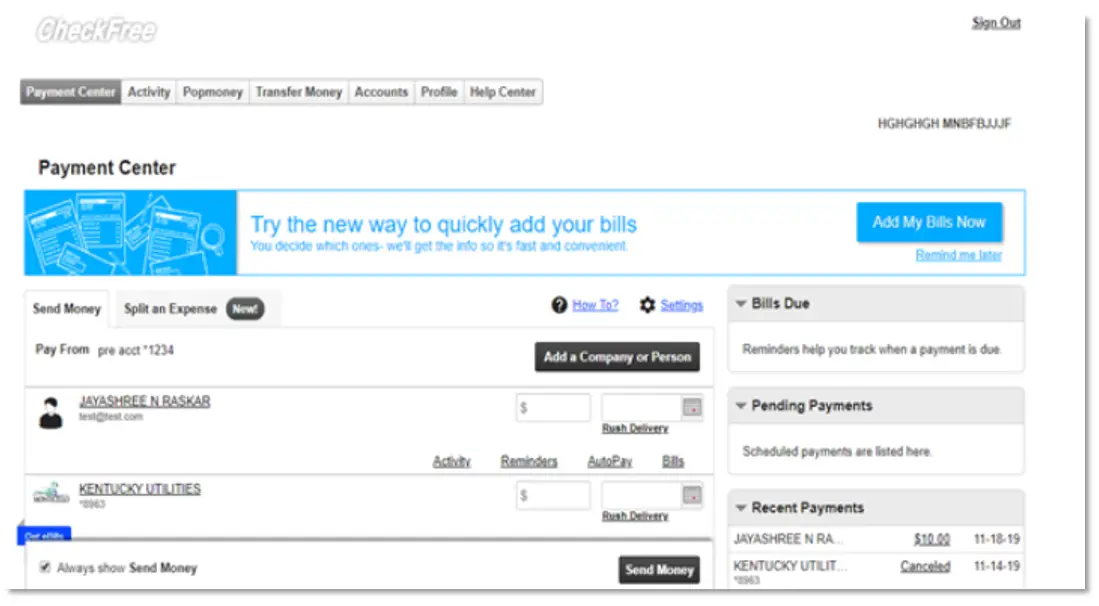

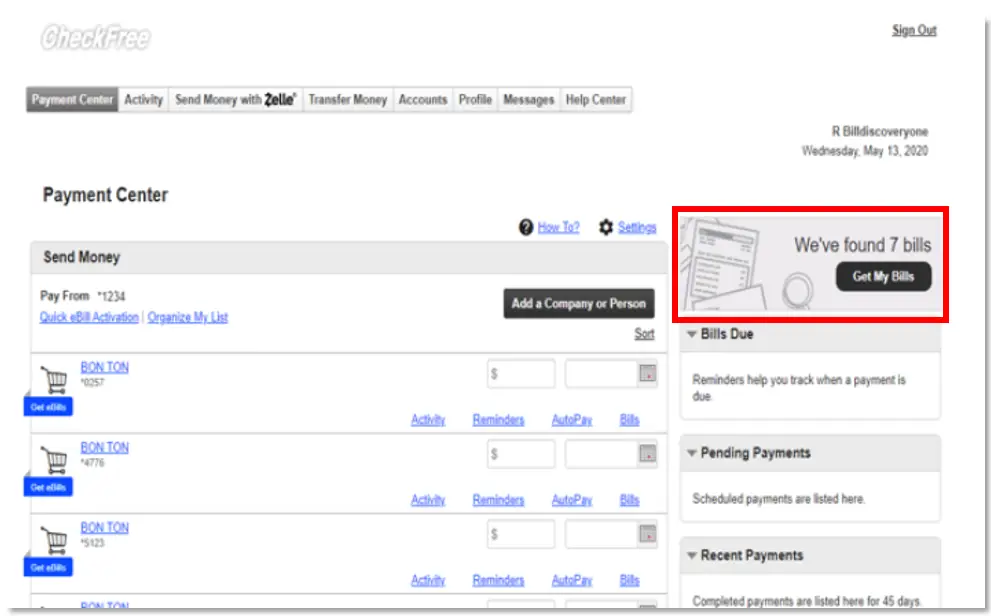

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card. Click on the three vertical dots alongside the blue “Pay” button

Click on the three vertical dots alongside the blue “Pay” button