3-5 Years

You need money to buy things.You earn money by working.

You may have to wait before you can buy something you want.

There is a difference between things you want and things you need.

6-10 Years

You need to make choices about how to spend your money.It’s good to shop around and compare prices before you buy.

It can be costly and dangerous to share information online.

Putting your money in a savings account will protect it and pay you interest.

11-13 Years

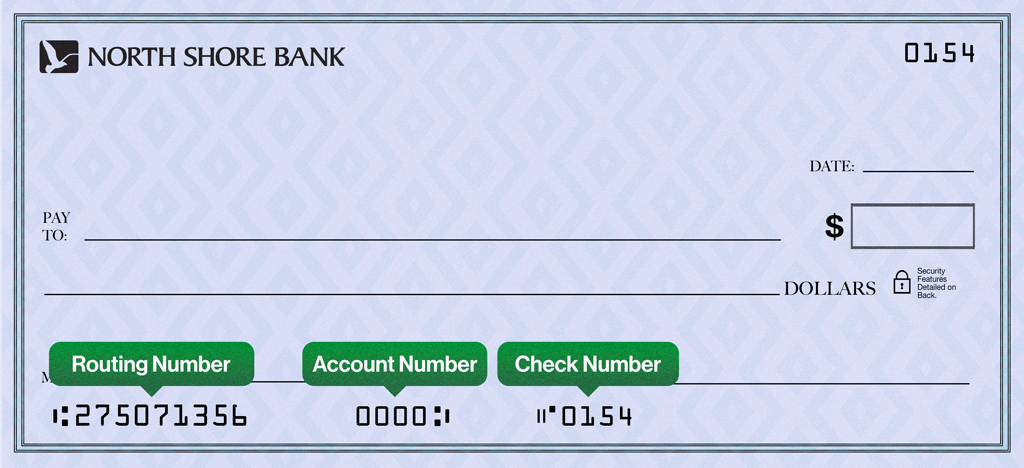

You should save at least a dime for every dollar you receive.Entering personal information, like a bank or credit card number, online is risky because someone could steal it.

The sooner you save, the faster your money can grow from compound interest. Using a credit card is like taking out a loan.

If you don’t pay your bill in full every month, you’ll be charged interest and owe more than you originally spent.

14-18 Years

When comparing colleges, be sure to consider how much each school will cost you.You should avoid using credit cards to buy things you can’t afford to pay for with cash.

Your first paycheck may seem smaller than expected since money is taken out for taxes.

A great place to save and invest money you earn is in a Roth IRA.

18+ Years

When comparing colleges, be sure to consider how much each school will cost you.You should avoid using credit cards to buy things you can’t afford to pay for with cash.

Your first paycheck may seem smaller than expected since money is taken out for taxes.

A great place to save and invest money you earn is in a Roth IRA.

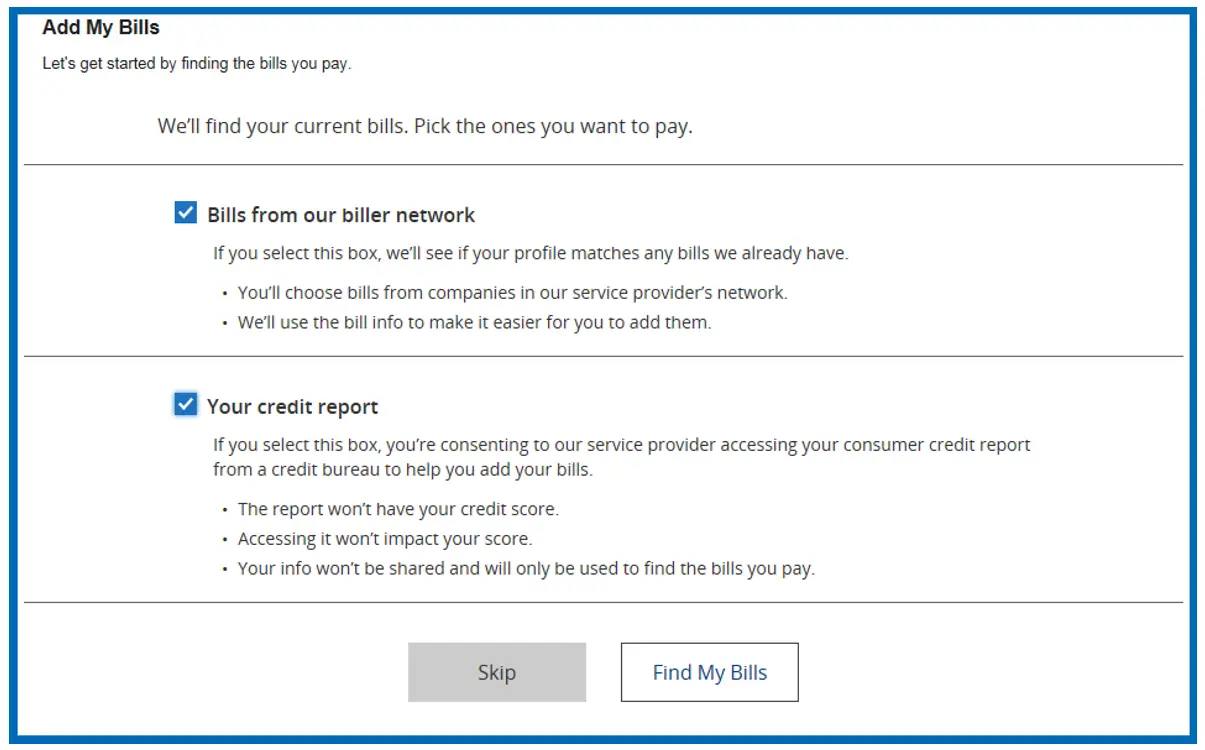

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card.

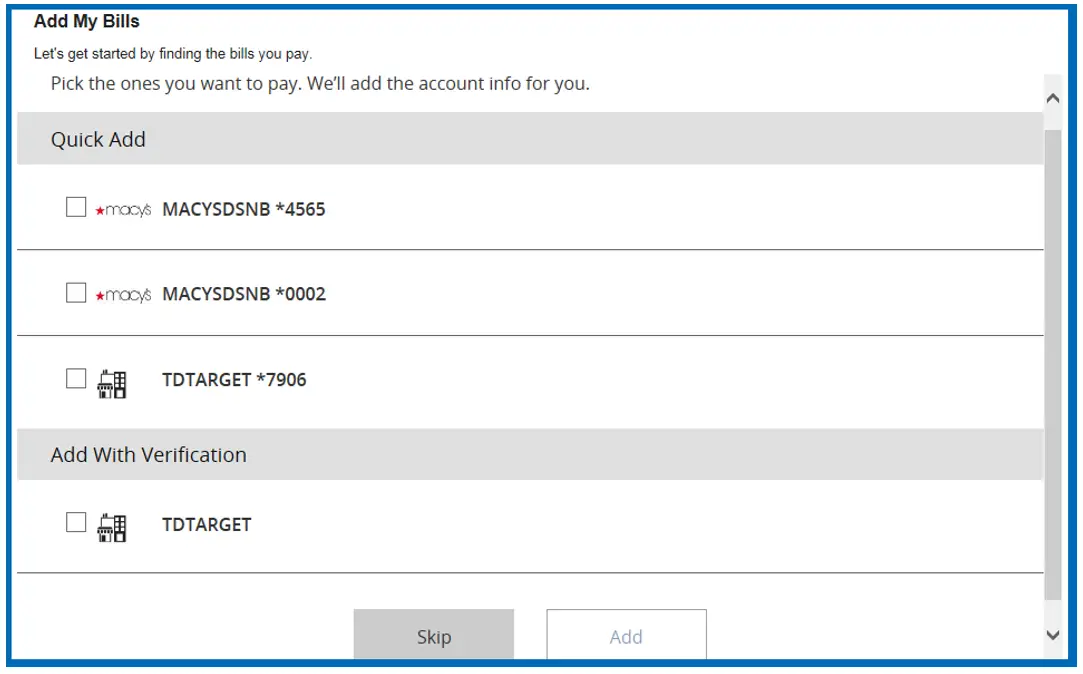

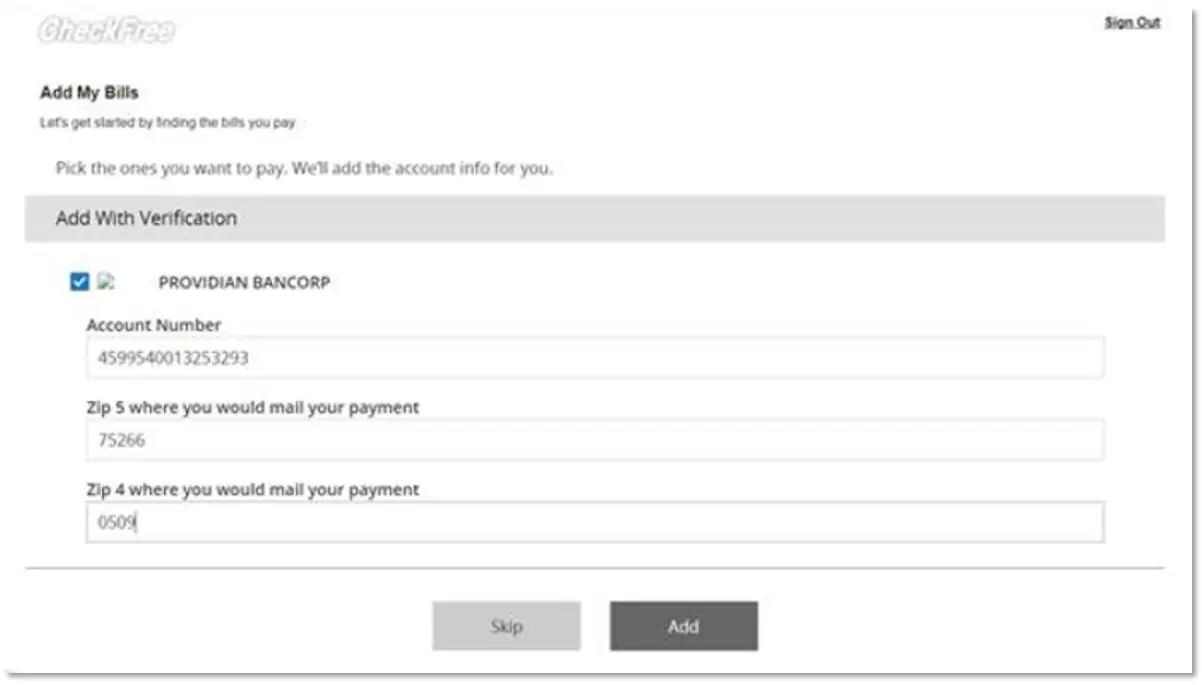

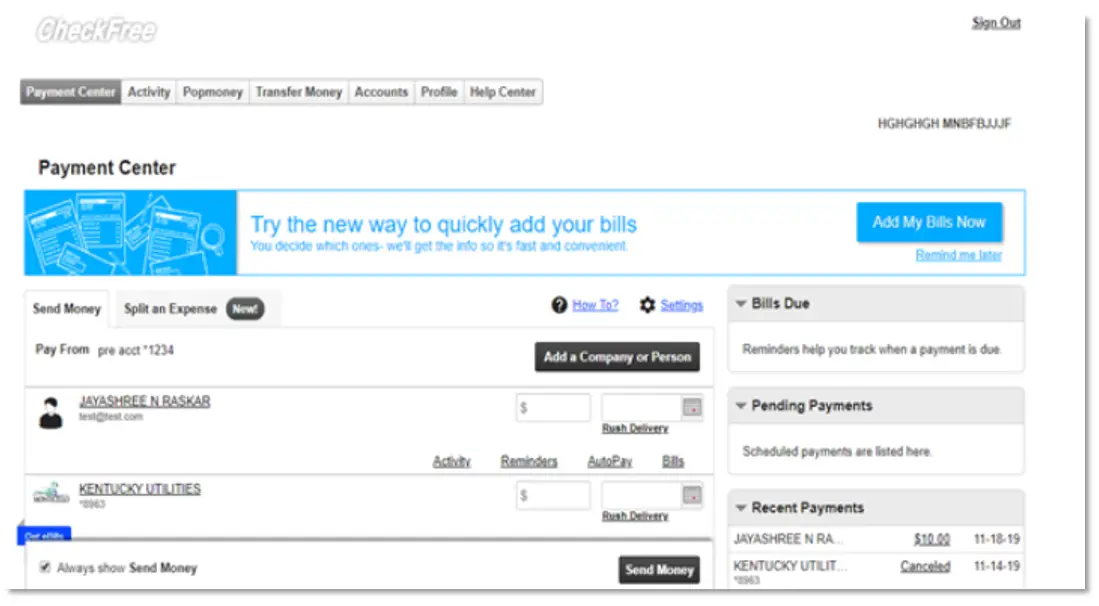

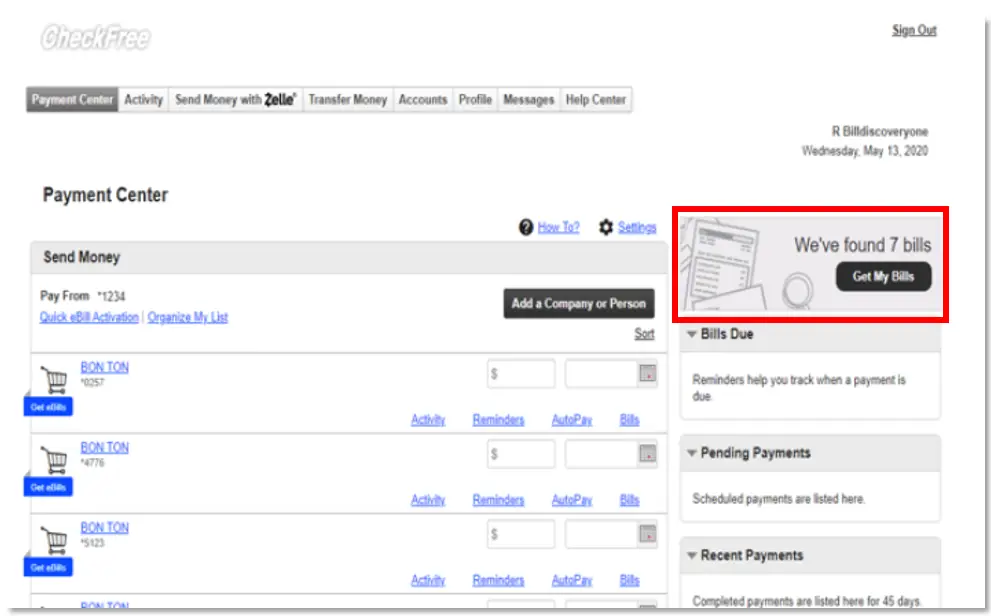

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card. Click on the three vertical dots alongside the blue “Pay” button

Click on the three vertical dots alongside the blue “Pay” button