With many homes drawing multiple offers within a few days or even just hours after hitting the market, real estate agents are advising would-be buyers to nail down a solid mortgage loan pre-approval before they start looking.

“Pre-approval is extremely important in a competitive market,” said Alexis Ruzell, with Realty Executives Integrity on the North Shore. “And it’s important to know what kind of pre-approval you are getting. Are you getting one the bank will stand behind?”

There is a big difference between “pre-qualification” and pre-approval. Pre-qualification is typically something you can get without anybody actually checking your credit and reviewing your income versus your debts. It’s a ballpark estimate of your buying power. Pre-approval is based on verification of income, assets and credit.

With a solid pre-approval, you can make an offer with the confidence that, if it fits the parameters of the pre-approval we’ve given you, you’ll be able to get the mortgage.”

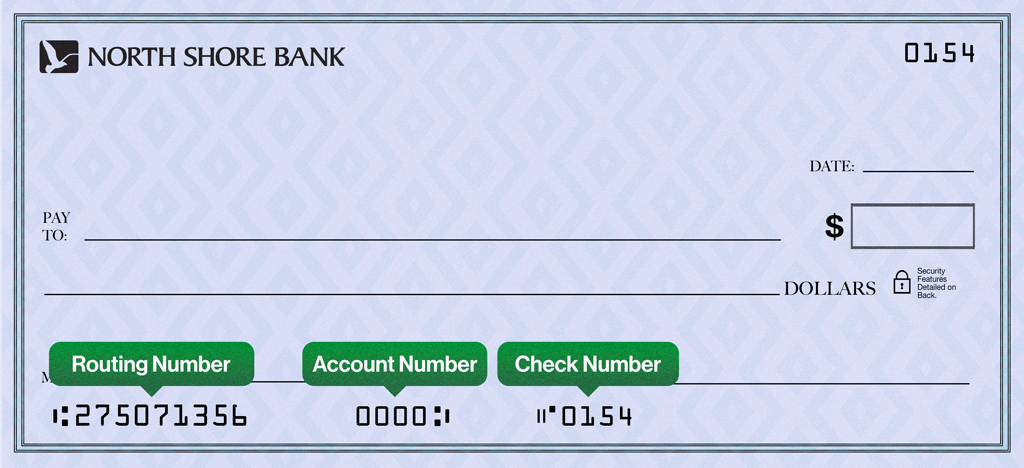

Getting pre-approved doesn’t have to be time-consuming, he added, noting that visitors to the North Shore Bank website can obtain a pre-approval letter 24 hours a day. The bank’s data processing system instantly verifies information submitted by the applicant, pulls credit scores from third-party databases, determines if you qualify for the loan amount submitted, and generates a pre-approval letter for that amount – in other words, exactly the same steps that would occur with an in-person application.

“There’s no waiting time when it comes to making an offer,” said Ruzell. “You need to come to the table with your financing arrangements in order.”

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card.

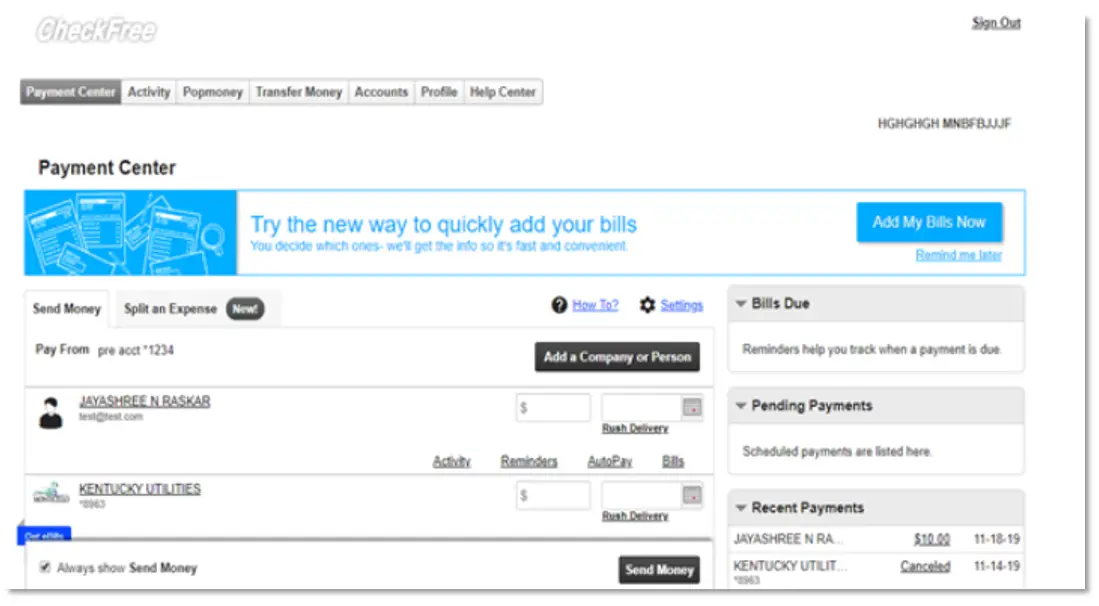

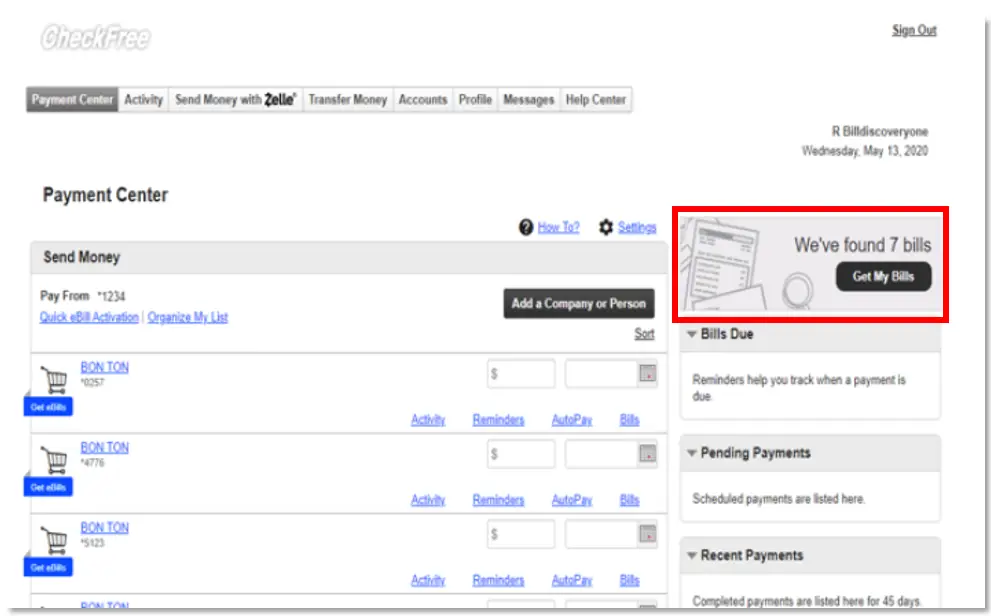

When opening an account online, your initial deposit must be done by transferring money from your current bank account or by debit or credit card. Click on the three vertical dots alongside the blue “Pay” button

Click on the three vertical dots alongside the blue “Pay” button