If you are looking to safely establish or improve your credit score, consider a North Shore Bank Credit Builder Loan.

How it Works

Once you apply and are approved for a Credit Builder Loan, the amount you borrow is held in a Certificate of Deposit account while you make monthly payments. When the loan is paid in full, you have access to the funds in the Certificate of Deposit plus accrued interest. Along with a boosted credit score, you have built up savings while repaying the loan.*

Helping You Build Credit

The key to the Credit Builder Loan is making your on-time monthly payments, the purpose of which is to demonstrate your ability to manage debt. In turn, this gets reported to the credit bureau and helps you establish or build your credit score.

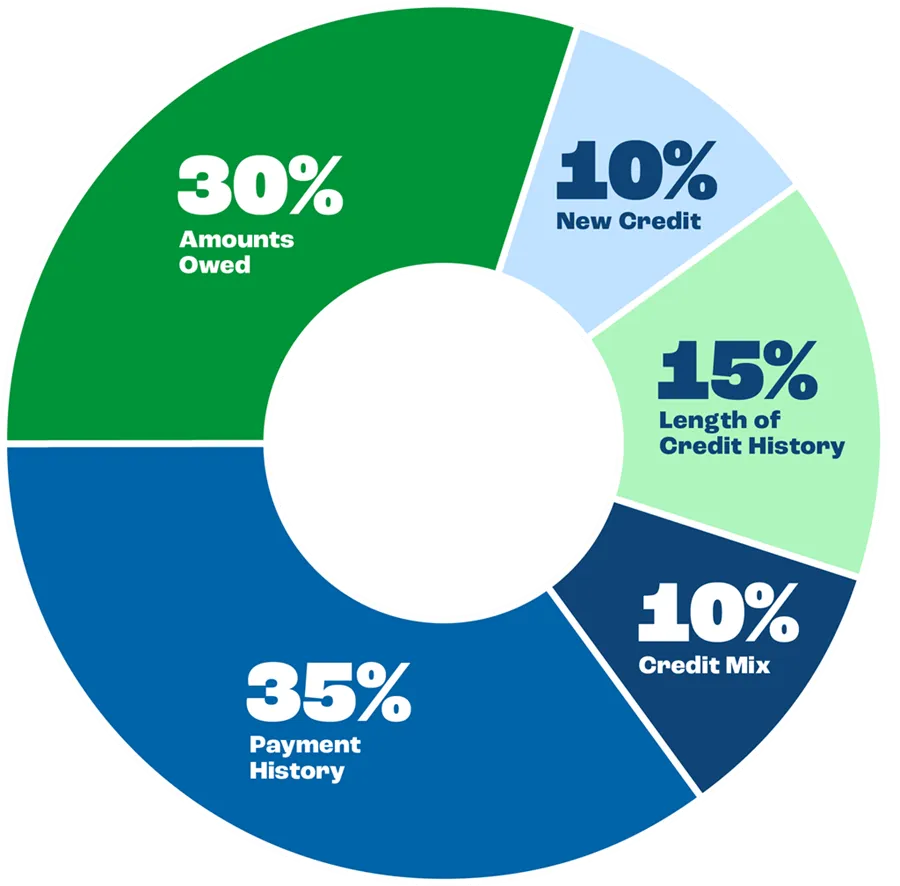

As you can see from this graphic from FICO, your payment history makes up 35% of how your credit score is calculated and is the biggest factor in establishing good credit.

Selecting the Right Loan

for You

It’s important to select the right loan term and dollar amount for your Credit Builder Loan so that you can comfortably make your monthly payments on time. North Shore Bank offers several Credit Builder Loan options and we’re happy to meet with you to determine the best fit for you for your individual needs and situation.

| Credit Builder Loan Options | |||

|---|---|---|---|

| Term | Loan Amount | Rate | Payment |

| 12 Months | $1,000 | 6.00% APR | $86.08 |

| 12 Months | $2,000 | 6.00% APR | $172.16 |

| 24 Months | $3,000 | 6.00% APR | $132.98 |

| 24 Months | $4,000 | 6.00% APR | $177.31 |

Annual Percentage Rates (APR), terms, and availability of product are subject to change at any time. Limit one per customer. Loans are subject to approval.

*Improvements in credit score are not guaranteed and require all loan payments made on time.

Click on the three vertical dots alongside the blue “Pay” button

Click on the three vertical dots alongside the blue “Pay” button