Everyday Checking

A simple account with no monthly maintenance fee, no minimum balance, and no surprises

Easy-to-Use Extras with Every Checking Account

Whether it’s protecting your identity, teaching your kids money smarts, or ensuring easy access to your cash, your financial well-being is our shared success.

Benefits

-

Unlimited free overdraft protection transfers from a qualified North Shore Bank deposit account

-

Free eStatements

-

Every checking account includes access to over 33,000 free ATMs with MoneyPass, ID Theft Protection, and Greenlight, the money app and debit card for kids and families.

Monthly Maintenance Fee

$0

Ways to Waive Monthly Maintenance Fee

No account maintenance fee

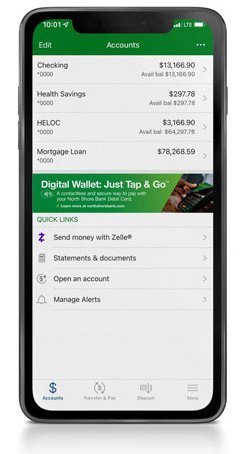

Power Up Your Checking Account With

Our Top-Rated Mobile App*

Deposit Checks

Deposit paper checks using your phone's built-in camera

Zelle®

With Zelle®, it’s easy to send and receive money to friends and family

Manage and Pay Bills

Easily add, pay and manage your bills all in one secure place

Account Transfers

Easily transfer funds between your North Shore Bank accounts and external accounts

My Card Manager

Control your debit card, set transaction limits, view spending insights, and more

My Credit Score

Review and improve your credit score with this free resource

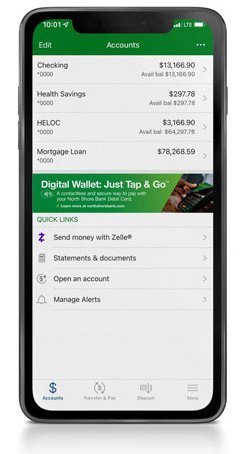

Power Up Your Checking Account With

Our Top-Rated Mobile App*

Deposit Checks

Deposit paper checks using your phone's built-in camera

Zelle®

With Zelle®, it’s easy to send and receive money to friends and family

Manage and Pay Bills

Easily add, pay and manage your bills all in one secure place

Account Transfers

Easily transfer funds between your North Shore Bank accounts and external accounts

My Card Manager

Control your debit card, set transaction limits, view spending insights, and more

My Credit Score

Review and improve your credit score with this free resource

Getting Started is Easy

Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. © 2025 Mastercard. All rights reserved.