Checking Accounts Designed to Fit Your Needs

Premier Checking

Interest-bearing account with free out-of-network ATM withdrawals* and double the rewards with a Platinum Debit Card*

Advantage Checking

An upgraded account that earns double the rewards with a Platinum Debit Card*

Everyday Checking

A simple account with Debit Rewards, no monthly maintenance fee, no minimum balance, and no surprises

Specialty Checking Accounts

Student Checking

The ideal starter account for ages 13+ with no minimum balance or monthly maintenance fee

Balance Checking

Free yourself from worry about overdraft fees with a checking account that offers nationwide ATM access, a free Standard Debit Card, and much more.

Easy-to-Use Extras with Every Checking Account

Whether it’s protecting your identity, teaching your kids money smarts, or ensuring easy access to your cash, your financial well-being is our shared success.

Choose the Debit Card That's Right for You

Banking Options for a Growing Family

Seymour Savings

Learning to save is important. No minimum balance for those under 21.

Greenlight

Debit card and money app for kids at no cost.

Student Checking

For ages 13+, teach money management skills with no monthly maintenance fee and no minimum balance.

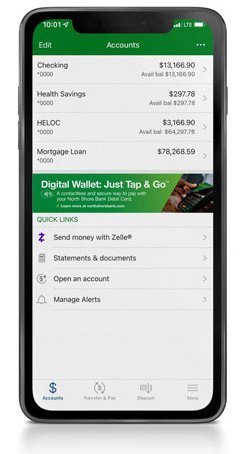

Power Up Your Checking Account With

Our Top-Rated Mobile App*

Deposit Checks

Deposit paper checks using your phone's built-in camera

Zelle®

With Zelle®, it’s easy to send and receive money to friends and family

Manage and Pay Bills

Easily add, pay and manage your bills all in one secure place

Account Transfers

Easily transfer funds between your North Shore Bank accounts and external accounts

My Card Manager

Control your debit card, access Debit Rewards, set transaction limits, view spending insights, and more

My Credit Score

Review and improve your credit score with this free resource

Your Toolkit for

Financial Success

Calculators & Coaches

Blog Posts

Getting Started is Easy

Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. © 2025 Mastercard. All rights reserved.