Spend. Earn. Repeat.

Open a Checking Account & easily enroll in Debit Rewards through our Mobile App to start earning with every purchaseChecking Accounts Designed to Fit Your Needs

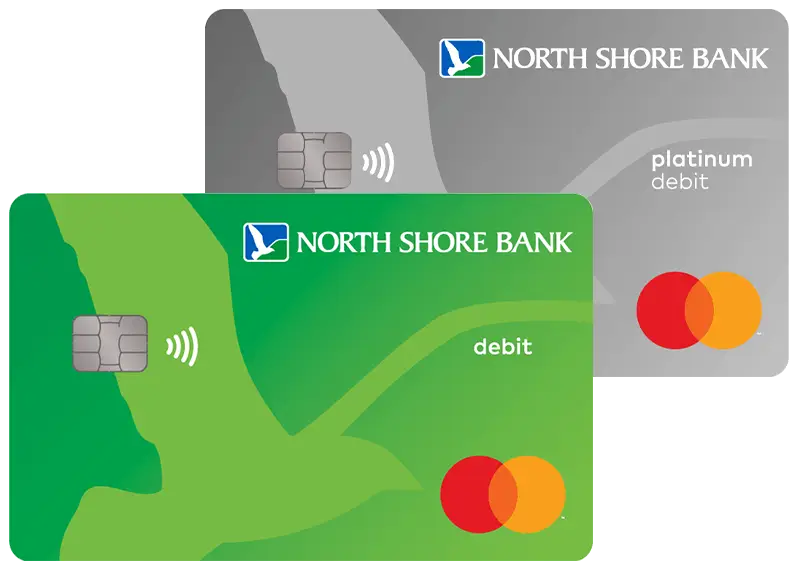

Premier Checking

Interest-bearing account with free out-of-network ATM withdrawals* and double the rewards with a Platinum Debit Card*

Advantage Checking

An upgraded account that earns double the rewards with a Platinum Debit Card*

Everyday Checking

A simple account with Debit Rewards, no monthly maintenance fee, no minimum balance, and no surprises

No Hassle, Just Rewards

With Debit Rewards, you'll earn points on every North Shore Bank Debit Card purchase* - with no caps and no extra effort. Redeem points for cash back, gift cards, or even Amazon purchases, all right from your Mobile App.

Why Debit Rewards?

Everyday purchases should work harder for you. With Debit Rewards, your debit card does more than pay—it earns.

What you’ll love:

- Earn points on all North Shore Bank Debit Mastercard® purchases

- No limits on how many points you can earn

- Redeem for cash back, gift cards, and more

- Track and redeem points easily within the Mobile App

It’s Easy to Register for Debit Rewards

Step 1 – Tap to Start

Tap Rewards under Cards in the Mobile App

Step 2 – Accept Terms

Accept the terms, and you’re in

Step 3 – Earn Rewards

Earn points on every debit card purchase

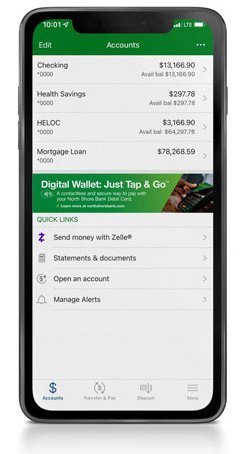

Power Up Your Checking Account With

Our Top-Rated Mobile App*

Deposit Checks

Deposit paper checks using your phone's built-in camera

Zelle®

With Zelle®, it’s easy to send and receive money to friends and family

Manage and Pay Bills

Easily add, pay and manage your bills all in one secure place

Account Transfers

Easily transfer funds between your North Shore Bank accounts and external accounts

My Card Manager

Control your debit card, access Debit Rewards, set transaction limits, view spending insights, and more

My Credit Score

Review and improve your credit score with this free resource